Report on Biofuel Tax Incentives and Alignment with Sustainable Development Goals

Executive Summary

This report analyzes the critical role of federal tax incentives in advancing the U.S. biofuels industry and its contribution to the United Nations Sustainable Development Goals (SDGs). Strategic regulatory implementation, particularly concerning the Section 45Z clean fuel production tax credit and the use of the GREET model for lifecycle analysis, is essential for decarbonization, economic growth, and technological innovation. The following sections detail the connection between biofuel policy, carbon reduction technologies, and key SDGs, providing recommendations to maximize positive impacts.

The Role of Tax Incentives in Advancing Sustainable Development

Fostering Clean Energy and Climate Action (SDG 7 & SDG 13)

Tax incentives are a primary driver for investment in technologies that reduce the carbon intensity (CI) of biofuels, directly supporting SDG 13 (Climate Action). A key technology is Carbon Capture, Utilization, and Storage (CCUS), where biogenic CO2 from ethanol production is sequestered or utilized in other industries. These investments not only lower emissions but also enable biofuel producers to qualify for larger incentives, creating a virtuous cycle of decarbonization. This progress is vital for developing next-generation fuels, such as Sustainable Aviation Fuel (SAF), which is crucial for achieving SDG 7 (Affordable and Clean Energy) by decarbonizing the aviation sector.

Promoting Innovation, Economic Growth, and Sustainable Communities (SDG 8 & SDG 9)

A technology-neutral approach to tax incentives is necessary to unleash SDG 9 (Industry, Innovation, and Infrastructure) across rural America. By providing regulatory certainty, the U.S. biofuels industry can compete globally and drive innovation. This, in turn, supports SDG 8 (Decent Work and Economic Growth) by creating jobs, strengthening Midwest communities, and ensuring the longevity of the liquid fuels sector.

Critical Analysis of Carbon Accounting Models

The GREET Model: A Tool for Accurate Climate Accounting

The U.S. Department of Energy’s Argonne GREET model is the gold standard for lifecycle carbon analysis of biofuels. Its use is fundamental to accurately crediting the emissions reductions from farm-based feedstocks, a prerequisite for effective climate policy under SDG 13. Failure to use the GREET model for tax credit administration would jeopardize national decarbonization targets, such as the SAF Grand Challenge, and exclude U.S. farmers and producers from global markets.

Discrepancies with the CORSIA Model and Implications for SDG 15 (Life on Land)

The Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) model presents a significant challenge. Its methodology for calculating indirect land-use change (iLUC) is based on outdated data and fails to account for modern agricultural innovations. In contrast, the GREET model incorporates recent data reflecting how farmers have increased yields while minimizing soil disturbance through climate-smart practices. These practices are essential for protecting ecosystems and align with SDG 15 (Life on Land). Relying on CORSIA would unfairly penalize U.S. bioethanol and lock producers out of the SAF market.

The 40B GREET Model: A Step Toward Sustainable Production (SDG 12)

The April 2024 guidance for the 40B SAF tax credit introduced a bespoke GREET model that assigns a lower iLUC value to bioethanol, aligning with scientific consensus. However, it requires that corn be farmed using a combination of three climate-smart practices: no-till farming, cover crops, and enhanced-efficiency fertilizers. While this provides a pathway, it is a stringent one. This focus on specific agricultural methods promotes SDG 12 (Responsible Consumption and Production) by directly linking incentives to sustainable practices.

Regulatory Recommendations for Maximizing SDG Impact

To fully realize the potential of biofuels to contribute to the Sustainable Development Goals, regulators should implement the following changes:

- Provide additional flexibility on prevailing wage provisions to support SDG 8 (Decent Work and Economic Growth). This includes geographic flexibility for job classifications and allowing for annual instead of quarterly compliance.

- Allow key carbon-reducing farm practices to qualify for the tax credit, advancing SDG 13 (Climate Action) and SDG 15 (Life on Land).

- Amend the “qualifying sale” regulation to include midstream ethanol sales, thereby strengthening the clean energy supply chain in line with SDG 7 and SDG 9.

- Clarify that exported ethanol is eligible for the credit to promote global access to clean fuels (SDG 7).

- Update the 45ZCF-GREET User Manual to recognize food and beverage applications as a form of carbon utilization, supporting circular economy principles and SDG 12 (Responsible Consumption and Production).

- Finalize the Provisional Emissions Rate regulation to provide market certainty and encourage long-term investment in sustainable infrastructure (SDG 9).

Projected Economic and Social Contributions (SDG 8)

Implementing the Section 45Z tax credit using the GREET model is projected to deliver significant benefits, directly contributing to SDG 8 (Decent Work and Economic Growth):

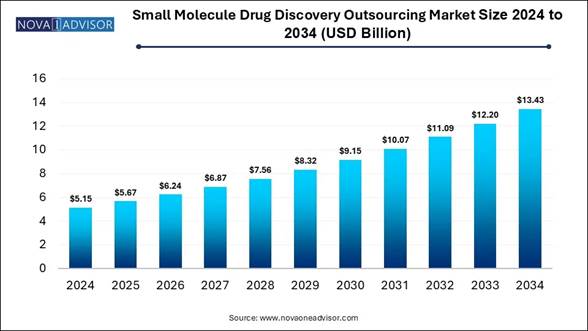

- Economic Contribution: An addition of $21.2 billion to the U.S. economy.

- Household Income: Generation of nearly $13.4 billion in new household income.

- Job Support: Sustaining more than 192,000 jobs across all sectors of the national economy.

- Agricultural Support: Providing farmers with a 10 percent price premium on low-carbon corn sold to ethanol plants.

SDGs, Targets, and Indicators Analysis

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 7: Affordable and Clean Energy

The article focuses on biofuels, specifically bioethanol and Sustainable Aviation Fuel (SAF), as cleaner energy alternatives to traditional fossil fuels. It discusses how tax incentives can spur the production of these renewable fuels, contributing to a cleaner energy mix. The text states, “biofuel producers and their products lower carbon emissions every day,” and highlights the goal of competing in “global next-generation fuel markets, particularly when it comes to sustainable aviation fuel (SAF).”

-

SDG 8: Decent Work and Economic Growth

The article explicitly links the adoption of clean fuel tax incentives to significant economic benefits. It claims that using the GREET model for the 45Z tax credit “would add $21.2 billion to the U.S. economy, generate nearly $13.4 billion in household income, support more than 192,000 jobs across all sectors of the national economy, and provide farmers with a 10 percent premium price on low carbon corn.” This directly addresses economic growth and job creation, particularly in rural America.

-

SDG 9: Industry, Innovation, and Infrastructure

The article emphasizes the role of tax incentives in “spurring investments in technologies that further lower their carbon intensity.” It specifically identifies “carbon capture, utilization, and storage (CCUS)” as a key technology. This aligns with promoting sustainable industrialization, fostering innovation, and upgrading infrastructure to be cleaner and more efficient.

-

SDG 13: Climate Action

The central theme of the article is the reduction of carbon emissions to combat climate change. It evaluates different models (GREET, CORSIA) for measuring “carbon intensity (CI) scores” and advocates for policies that effectively lower emissions from the transportation sector. The entire discussion around decarbonizing the airline fleet through SAF and lowering the CI score of bioethanol directly supports climate action.

-

SDG 15: Life on Land

The article discusses the impact of biofuel production on land use, referencing “land-use change (LUC).” It highlights the importance of “climate smart agricultural practices—cover crops, no-till farming, and enhanced fertilizer” in reducing the carbon footprint of bioethanol. These practices contribute to sustainable land management by improving soil health and minimizing soil disturbance, which helps soil “capture and store carbon.”

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Target 7.2: Increase substantially the share of renewable energy in the global energy mix.

The article’s advocacy for biofuels like bioethanol and SAF is a direct effort to increase the proportion of renewable energy in the transportation fuel sector, one of the largest energy-consuming sectors.

-

Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading and innovation.

The text describes how tax incentives can “unleash innovation and job opportunities” by encouraging investment in advanced technologies like CCUS, thereby increasing the productivity and competitiveness of the U.S. biofuels industry.

-

Target 9.4: Upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies.

The promotion of CCUS technology is a clear example of retrofitting the ethanol production industry to make it more sustainable by capturing biogenic CO2 emissions. This represents a move towards cleaner industrial processes.

-

Target 13.2: Integrate climate change measures into national policies, strategies and planning.

The article is centered on the implementation of national policies—specifically the Inflation Reduction Act’s (IRA) tax credits (40B and 45Z)—as a mechanism to achieve climate goals like the “decarbonization of the airline fleet.” The debate over which lifecycle analysis model (GREET vs. CORSIA) to use is a core part of integrating climate measures into policy.

-

Target 15.3: Combat desertification, restore degraded land and soil, including land affected by desertification, drought and floods, and strive to achieve a land degradation-neutral world.

The article promotes “climate smart agricultural practices” such as “no-till farming” and “cover crops.” These methods are known to prevent soil erosion, improve soil organic matter, and enhance carbon sequestration in the soil, directly contributing to the restoration and health of agricultural land.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Carbon Intensity (CI) Score

This is the primary quantitative indicator mentioned throughout the article. The GREET and CORSIA models are used to calculate CI scores for biofuels. A lower CI score indicates lower lifecycle greenhouse gas emissions, directly measuring progress towards SDG 7 and SDG 13.

-

Economic and Employment Figures

The article provides specific quantitative indicators for economic progress under SDG 8, including “$21.2 billion” in economic contribution, “192,000 jobs” supported, and “$13.4 billion in household income.”

-

Adoption of Climate-Smart Agricultural Practices

An implied indicator for SDG 15 is the rate of adoption by farmers of the three specified practices: “cover crops, no-till farming, and enhanced fertilizer.” The article notes that the 40B guidance requires all three, making their combined adoption a measurable outcome.

-

Investment in and Adoption of Clean Technologies

An indicator for SDG 9 is the level of investment in and deployment of technologies like “carbon capture, utilization, and storage (CCUS)” by biofuel producers. The article suggests tax incentives are designed to spur these investments.

-

Production Volume of Sustainable Aviation Fuel (SAF)

The article frequently mentions SAF as a key next-generation fuel. The volume of SAF produced and used, particularly from bioethanol feedstocks, serves as a direct indicator of progress in decarbonizing aviation and advancing clean energy (SDG 7 and SDG 13).

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 7: Affordable and Clean Energy | 7.2: Increase substantially the share of renewable energy in the global energy mix. | – Production volume of bioethanol and Sustainable Aviation Fuel (SAF). – Share of biofuels in the transportation fuel market. |

| SDG 8: Decent Work and Economic Growth | 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading and innovation. | – Dollar value added to the U.S. economy ($21.2 billion). – Number of jobs supported (192,000). – Household income generated ($13.4 billion). – Premium price for low-carbon corn (10%). |

| SDG 9: Industry, Innovation, and Infrastructure | 9.4: Upgrade infrastructure and retrofit industries to make them sustainable…and with greater adoption of clean and environmentally sound technologies. | – Level of investment in Carbon Capture, Utilization, and Storage (CCUS). – Number of biofuel facilities adopting CCUS and other emissions-reducing technologies. |

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies, strategies and planning. | – Carbon Intensity (CI) score of biofuels as measured by models like GREET. – Implementation of tax credits (40B, 45Z) tied to emissions reduction. |

| SDG 15: Life on Land | 15.3: …strive to achieve a land degradation-neutral world. | – Rate of adoption of climate-smart agricultural practices (no-till, cover crops, enhanced fertilizer). – Measurement of land-use change (LUC) impacts. |

Source: growthenergy.org