Report on New U.S. Overtime Tax Policies and Their Impact on Sustainable Development Goals

Executive Summary

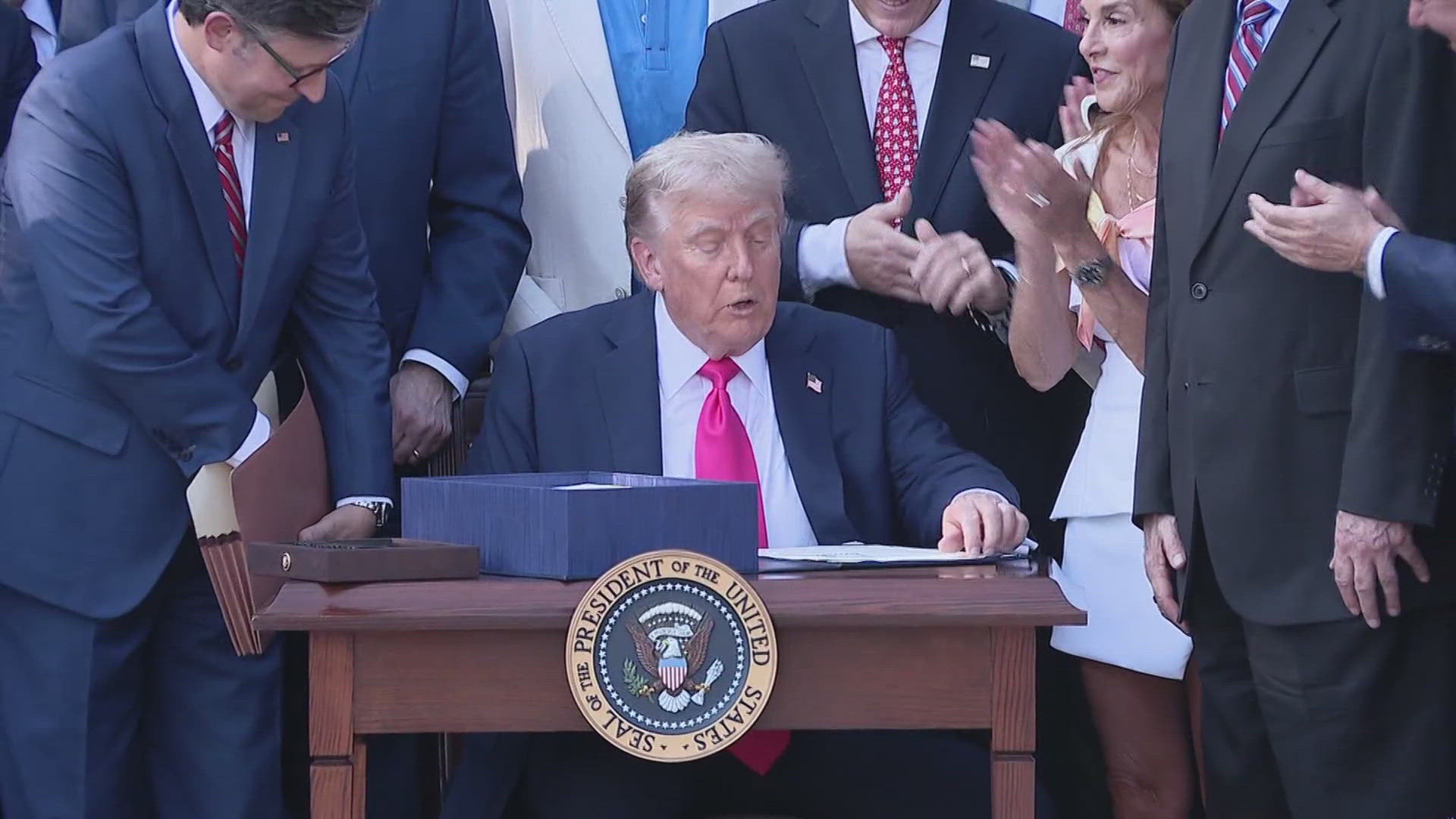

A recently passed United States legislative bill introduces significant changes to the tax policies governing overtime wages, carrying substantial implications for both employers and employees. This report analyzes these new regulations through the framework of the United Nations Sustainable Development Goals (SDGs). The analysis focuses primarily on SDG 8 (Decent Work and Economic Growth), SDG 10 (Reduced Inequalities), and SDG 1 (No Poverty). The legislation presents opportunities to advance decent work through new tax breaks but also introduces compliance challenges and potential risks to income equality. Key areas of examination include tax breaks under the Fair Labor Standards Act (FLSA), modifications to W2 reporting, and the potential effects on overtime work incentives.

Analysis of New Tax Regulations and Alignment with SDGs

SDG 8: Promoting Decent Work and Economic Growth

The new legislation directly impacts the principles of decent work by altering the financial landscape of overtime compensation. Its alignment with SDG 8 hinges on balancing employer incentives with fair employee remuneration.

- Overtime Work Incentives: The revised tax structure may affect the financial viability of offering overtime for employers and the motivation for employees to accept it. This could influence overall economic productivity and the attainment of full and productive employment.

- Employer Tax Breaks: The bill provides for tax breaks under the Fair Labor Standards Act (FLSA). These are intended to support business sustainability, enabling companies to protect jobs and foster economic growth.

- Implementation Challenges: Efficient management of these new regulations is critical. For employers, navigating the complexities is a potential challenge that could hinder the realization of the bill’s intended economic benefits.

SDG 10: Reduced Inequalities

Fiscal and wage policies are critical tools for achieving greater equality. The impact of this legislation on different income strata is a key consideration for its contribution to SDG 10.

- Impact on Wage Earners: Changes to overtime taxation will have a pronounced effect on hourly workers, who often depend on this income. The policy’s structure will determine whether it helps to reduce or exacerbate income inequality.

- Reporting and Transparency: The legislation mandates changes in reporting requirements for W2 forms. While this can promote transparency and fairer taxation, increased complexity could lead to errors that disproportionately affect lower-wage employees.

SDG 1: Implications for Poverty Reduction

For many households, overtime pay is a crucial component of income that helps them remain above the poverty line. The net effect of these tax changes on take-home pay is therefore directly relevant to SDG 1.

- Impact on Disposable Income: The final impact on an employee’s net pay after overtime is a critical factor for the financial stability of low-income families.

- Financial Security: Fair and predictable compensation for overtime work is essential for household financial planning and security, forming a buffer against poverty.

Operational and Compliance Framework for Employers

Fair Labor Standards Act (FLSA) Compliance

The legislation is intertwined with existing labor laws, requiring careful navigation by employers.

- The bill introduces new tax breaks that are directly linked to FLSA provisions.

- Employers must ensure that their application of these tax breaks is fully compliant with all FLSA wage and hour regulations to avoid legal penalties.

Administrative and Reporting Adjustments

The operational impact of the bill centers on new administrative duties for employers.

- A primary change involves updated reporting requirements for employee W2 forms.

- Accurate and timely implementation of these changes within payroll systems is mandatory for compliance.

Recommendations for Stakeholders

For Employers

- Conduct a comprehensive review of the new tax policies to understand their interaction with FLSA and other relevant regulations.

- Update payroll, accounting, and human resources systems to correctly implement the new W2 reporting requirements.

- Communicate all changes transparently to employees, providing clear information on how their compensation and tax withholdings will be affected.

- Seek specialist legal and financial advice to ensure full compliance and to strategically manage the new regulations.

For Policymakers and Oversight Bodies

- Establish monitoring systems to track the socio-economic impacts of the legislation, focusing on its contribution toward achieving SDG 8 and SDG 10.

- Develop and disseminate clear guidance to help businesses, particularly small and medium-sized enterprises, understand and comply with the new rules.

- Evaluate the policy’s long-term effects on overtime availability, household income levels, and national poverty rates to ensure alignment with SDG 1.

1. Relevant Sustainable Development Goals (SDGs)

The article primarily addresses issues related to the following SDGs:

- SDG 8: Decent Work and Economic Growth

- SDG 16: Peace, Justice and Strong Institutions

Detailed Explanation:

- SDG 8 is relevant because the article’s core topic is employment law and compensation. It discusses “new tax policies on overtime wages,” the “FLSA” (Fair Labor Standards Act), and how these changes affect “employers and employees,” which are central themes of decent work.

- SDG 16 is connected through the discussion of a “recently passed ‘big, beautiful bill'” and the resulting “new regulations.” This points to the function of legislative and governmental institutions in creating and implementing laws, which is a key aspect of developing strong institutions.

2. Specific SDG Targets

Based on the article’s content, the following specific targets can be identified:

-

SDG 8: Decent Work and Economic Growth

- Target 8.5: By 2030, achieve full and productive employment and decent work for all women and men… and equal pay for work of equal value.

- Justification: The article’s focus on “overtime wages,” “tax breaks,” and “overtime work incentives” directly relates to ensuring fair compensation and the principles of decent work.

- Target 8.8: Protect labour rights and promote safe and secure working environments for all workers…

- Justification: The discussion revolves around a new bill and its relation to the “FLSA” (Fair Labor Standards Act), which is a fundamental piece of legislation for protecting labor rights in the United States. The article advises on how to manage these “new regulations,” highlighting the importance of compliance with labor laws.

- Target 8.5: By 2030, achieve full and productive employment and decent work for all women and men… and equal pay for work of equal value.

-

SDG 16: Peace, Justice and Strong Institutions

- Target 16.6: Develop effective, accountable and transparent institutions at all levels.

- Justification: The article centers on a “recently passed ‘big, beautiful bill'” and the subsequent “new regulations.” This represents the output of legislative institutions. The mention of “changes in reporting requirements for W2 forms” is a direct example of measures to ensure transparency and accountability in the implementation of the new law.

- Target 16.6: Develop effective, accountable and transparent institutions at all levels.

3. Mentioned or Implied Indicators

The article implies several indicators that can be used to measure progress towards the identified targets:

- For Target 8.5:

- Implied Indicator: Existence and implementation of new tax policies on overtime wages. The article explicitly states that the attorneys “break down… new tax policies on overtime wages,” which serves as a direct indicator of policy change affecting worker compensation.

- For Target 8.8:

- Implied Indicator: National compliance with labour rights through new legislation. The “recently passed ‘big, beautiful bill'” and its connection to the FLSA serve as an indicator of the evolution and enforcement of labor laws.

- For Target 16.6:

- Implied Indicator: Implementation of new reporting requirements for employers. The article specifically points to “changes in reporting requirements for W2 forms” as a consequence of the new bill. This is a measurable indicator of institutional efforts to ensure transparency and compliance.

4. Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 8: Decent Work and Economic Growth | Target 8.5: Achieve full and productive employment and decent work for all… and equal pay for work of equal value. | Implementation of new tax policies on overtime wages. |

| SDG 8: Decent Work and Economic Growth | Target 8.8: Protect labour rights and promote safe and secure working environments for all workers… | National compliance with labour rights through new legislation (e.g., the “recently passed ‘big, beautiful bill'” amending rules under the FLSA). |

| SDG 16: Peace, Justice and Strong Institutions | Target 16.6: Develop effective, accountable and transparent institutions at all levels. | Implementation of new reporting requirements for employers (e.g., “changes in reporting requirements for W2 forms”). |

Source: mondaq.com