Analysis of U.S. Trade Policy and its Implications for Sustainable Development Goals

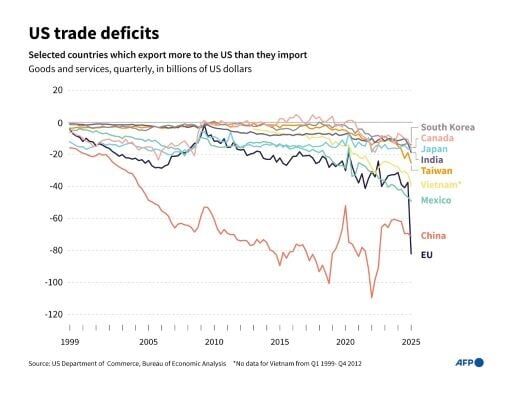

Recent trade agreements established by the United States with Japan and the European Union aim to achieve two primary objectives: reducing the bilateral trade deficit and securing substantial foreign investment commitments. However, a fundamental economic accounting identity suggests these goals are mutually exclusive. This report analyzes the relationship between trade deficits and foreign investment, with significant emphasis on the implications for achieving the Sustainable Development Goals (SDGs).

The Economic Interdependence of Trade and Investment

SDG 17: Partnerships for the Goals

The agreements represent a form of global partnership, central to SDG 17. The EU has committed to investing $750 billion in the U.S., while Japan has pledged over $550 billion. These partnerships are intended to foster economic integration and shared growth. However, the mechanics of these investments are intrinsically linked to trade balances.

- To invest in the United States, foreign entities in Japan and the EU require U.S. dollars.

- As noted by Maury Obstfeld, a senior fellow at the Peterson Institute for International Economics, these dollars are primarily acquired by exporting goods and services to the U.S.

- Therefore, the U.S. trade deficit serves as the mechanism that supplies foreign partners with the dollars needed for investment in the U.S. economy.

Gene Grossman, a professor of international economics at Princeton, affirms this is “a matter of accounting, not a matter of economic theory.” An increase in foreign investment, such as the committed $550 billion from Japan, will necessarily be reflected as a larger U.S. trade deficit.

Impact on Key Sustainable Development Goals

SDG 8 & 9: Economic Growth, Decent Work, and Infrastructure

The influx of foreign capital is targeted at bolstering SDG 8 (Decent Work and Economic Growth) and SDG 9 (Industry, Innovation, and Infrastructure). The investments are expected to fund the construction of new facilities, such as factories, which in turn creates employment and stimulates economic activity. This aligns directly with the goals of building resilient infrastructure and promoting sustainable industrialization.

Policy Coherence and Market Dynamics

The pursuit of contradictory policy goals—reducing the trade deficit while increasing foreign investment—creates policy incoherence that can undermine sustainable development progress. If tariffs were to successfully shrink the trade deficit while foreign investment demand remained high, market forces would produce an alternative outcome.

- High demand for a reduced supply of U.S. dollars from trade would cause the value of the dollar to appreciate.

- A more expensive dollar makes foreign goods cheaper for U.S. consumers and U.S. goods more expensive for foreign buyers.

- This shift in relative prices would lead to an increase in U.S. imports and a decrease in U.S. exports.

- The ultimate effect, as stated by Obstfeld, would be a larger U.S. trade deficit, thereby negating the initial policy objective.

Conclusion: Aligning Trade Policy with Sustainable Development

Historical Evidence and Future Outlook

Empirical data supports this economic framework. Liliana Rojas-Suarez, a senior fellow at the Center for Global Development, observed that following the 2018-19 tariffs, the U.S. trade deficit continued to increase. This was attributed to sustained foreign investment in the U.S., funded by the dollars sent abroad through imports.

For U.S. trade policy to effectively support the Sustainable Development Goals, it must acknowledge fundamental economic principles. Promoting foreign investment to advance SDG 8 and SDG 9 is a valid objective, but it will be accompanied by an expanded trade deficit. Recognizing this relationship is critical for creating stable and coherent global partnerships under SDG 17 and ensuring that economic policies contribute positively to long-term sustainable development, including the reduction of inequalities as envisioned in SDG 10.

Which SDGs are addressed or connected to the issues highlighted in the article?

- SDG 8: Decent Work and Economic Growth – The article’s focus on massive foreign investment as a driver for the U.S. economy directly connects to the goal of promoting sustained, inclusive, and sustainable economic growth.

- SDG 17: Partnerships for the Goals – The discussion revolves around international trade agreements, financial flows (investment), and macroeconomic policy coordination between the U.S., Japan, and the EU, which are central themes of SDG 17.

What specific targets under those SDGs can be identified based on the article’s content?

SDG 8: Decent Work and Economic Growth

- Target 8.1: Sustain per capita economic growth in accordance with national circumstances and, in particular, at least 7 per cent gross domestic product growth per annum in the least developed countries.

The article discusses commitments from Japan to invest “more than half a trillion dollars” and from the EU to invest “$750 billion” in the U.S. These large-scale investments are intended to stimulate economic activity and growth within the U.S., aligning with the objective of sustaining economic growth.

SDG 17: Partnerships for the Goals

- Target 17.5: Adopt and implement investment promotion regimes for least developed countries.

While the article focuses on a developed country (the U.S.), it describes the practical implementation of an investment promotion regime. The U.S. administration’s agreements with Japan and the EU that result in commitments of “$550 billion” and “$750 billion” respectively are a form of an investment promotion policy in action. - Target 17.10: Promote a universal, rules-based, open, non-discriminatory and equitable multilateral trading system under the World Trade Organization, including through the conclusion of negotiations under its Doha Development Agenda.

The article directly addresses international trade policy through its discussion of “trade agreements with Japan and the EU” and the use of “tariffs” as a tool to influence trade balances. This relates to the principles and mechanisms of the global trading system. - Target 17.13: Enhance global macroeconomic stability, including through policy coordination and policy coherence.

The core argument of the article highlights a lack of policy coherence. It explains that the goals of reducing the trade deficit and increasing foreign investment are contradictory from an accounting perspective. The analysis of how tariffs, investment flows, and currency values interact demonstrates the need for coherent macroeconomic policy to ensure stability, as mentioned by expert Liliana Rojas-Suarez who notes that “the trade deficit in the U.S. continued increasing” despite tariffs due to other macroeconomic factors like investment.

Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

For Target 8.1 (Sustain per capita economic growth)

- Implied Indicator: Foreign Direct Investment (FDI) inflows.

The article explicitly quantifies the committed investments which are a form of FDI: “Japan’s commitments to invest more than half a trillion dollars” and the EU’s commitment to invest “$750 billion.” These figures are direct measures of financial flows intended to boost economic growth.

For Target 17.10 (Promote a universal… multilateral trading system)

- Indicator 17.10.1: Worldwide weighted tariff-average.

The article explicitly mentions the use of “tariffs” and refers to the “2018-19 tariff” policy. The level of these tariffs is a direct measure for this indicator.

For Target 17.13 (Enhance global macroeconomic stability)

- Implied Indicator: Components of the Macroeconomic Dashboard.

The article discusses several key macroeconomic variables that are used to assess stability:- Trade Deficit: This is a central topic, with the article stating it is a “bigger U.S. trade deficit” and that it “continued increasing.”

- Foreign Investment: The article provides specific figures for committed foreign investment from Japan and the EU.

- Exchange Rate: The article discusses the potential for the “price of the dollar” to “become more expensive” as a result of policy actions.

SDGs, Targets and Indicators

| SDGs | Targets | Indicators Mentioned or Implied in the Article |

|---|---|---|

| SDG 8: Decent Work and Economic Growth | 8.1: Sustain per capita economic growth. | Foreign Direct Investment (FDI): The article quantifies investment commitments of “$550 billion” from Japan and “$750 billion” from the EU. |

| SDG 17: Partnerships for the Goals | 17.5: Adopt and implement investment promotion regimes. | Investment promotion commitments: The agreements securing specific, large-scale investment amounts from Japan and the EU. |

| 17.10: Promote a universal, rules-based, open, non-discriminatory and equitable multilateral trading system. | Tariffs: The article explicitly mentions the use of “tariffs” and “higher tariffs in the first Trump administration.” | |

| 17.13: Enhance global macroeconomic stability, including through policy coordination and policy coherence. | Macroeconomic Variables: The article discusses the “trade deficit,” “foreign investors,” and the “price of the dollar” (exchange rate) as interconnected factors. |

Source: marketplace.org