Report on Energy Policy and International Partnerships in the Context of Sustainable Development

Executive Summary

This report analyzes two significant developments in the energy sector and their alignment with the United Nations Sustainable Development Goals (SDGs). First, it examines how proposed tax policies in the United States could impede the growth of battery energy storage, a critical component for achieving SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action). Second, it assesses the feasibility of a major US-EU energy trade agreement, highlighting challenges related to SDG 17 (Partnerships for the Goals). The findings indicate that while ambitions for energy transition and security are high, policy and market realities present substantial obstacles to sustainable progress.

Energy Storage Policy and its Impact on Sustainable Development

Challenges to Grid Modernization and SDG 7 (Affordable and Clean Energy)

The momentum for battery energy storage systems, essential for grid stability and the integration of renewables, faces significant headwinds from potential policy shifts. While proposed legislation preserves tax credits, it introduces stringent rules that could slow deployment and compromise the objectives of SDG 7 and SDG 9 (Industry, Innovation, and Infrastructure).

- Supply Chain Constraints: The policy includes “foreign entity of concern” (FEOC) rules, which deny incentives for projects linked to countries like China. This is problematic as China dominates the global supply chain for critical minerals and battery cells.

- Domestic Production Gap: US domestic suppliers are projected to meet only 40% of the country’s energy storage demand by 2030. This gap will force developers to either rely on more expensive non-Chinese components or forfeit tax credits by using Chinese batteries, undermining the “affordable” aspect of SDG 7.

- Rising Project Costs: The limited supply of compliant, American-made products is expected to raise prices. This has already led some developers to scale back projects, with 16 battery energy storage projects reportedly downsized or cancelled in the current year.

- Weakened Renewable Demand: An earlier phaseout of solar and wind tax credits could further weaken demand for energy storage, as these technologies are often co-located. This creates a cascading negative effect on the broader clean energy ecosystem central to SDG 13 (Climate Action).

Market Response and Implications for SDG 12 (Responsible Consumption and Production)

The market is adapting to these challenges, with notable shifts in supply chain strategies and investment focus. These changes reflect an attempt to align with new regulations while pursuing goals related to SDG 8 (Decent Work and Economic Growth) and SDG 12.

- Surge in Demand for Alternatives: Non-Chinese battery manufacturers are experiencing a surge in demand. South Korea’s LG Energy Solution anticipates over 60% growth in demand for its energy storage systems and is expanding its US production capacity.

- Navigating Complex Regulations: Domestic and allied manufacturers must still navigate complex FEOC rules regarding the sourcing of minerals and components, which become progressively stricter. This complicates efforts to build resilient and responsible supply chains under SDG 12.

- Pressure on Domestic Manufacturing: The policy environment creates immense pressure on US manufacturers to scale up rapidly. However, analysts warn that making production-related tax credits more complex to achieve could “cut US manufacturing at the knees,” hindering domestic economic growth envisioned in SDG 8.

Assessment of the US-EU Energy Partnership and its Contribution to Global Goals

Evaluating the Feasibility of the Trade Agreement under SDG 17 (Partnerships for the Goals)

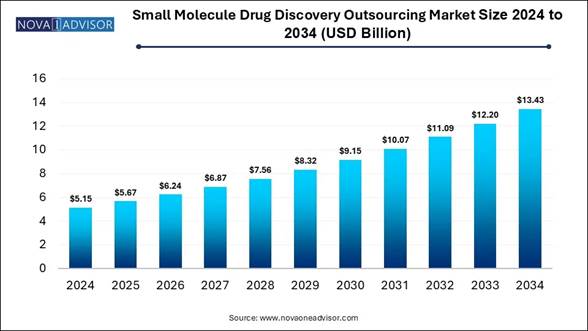

A recently announced US-EU trade deal stipulates that European companies will purchase $750 billion of American energy over three years. While intended to strengthen transatlantic ties and enhance energy security, the financial targets are viewed by analysts as highly ambitious, raising questions about the partnership’s practical contribution to SDG 17.

- The $250 Billion Annual Target: The European Commission asserts the target is based on a “robust assessment” aimed at ensuring the EU’s energy independence from Russia and supporting SDG 7 by securing supply.

- Analyst Skepticism: Market analysts have widely dismissed the target as “impossible to meet” or “heroic,” suggesting a disconnect between political ambition and commercial reality.

The Financial Gap in Achieving Energy Security Goals (SDG 7)

A breakdown of the numbers reveals a substantial gap between the agreement’s target and current and projected trade volumes. This shortfall highlights the challenges in using such partnerships to achieve tangible outcomes for SDG 7.

- Current Import Value: The EU’s current imports of US LNG, oil, and nuclear fuel are valued at approximately $90-$100 billion per year.

- Displacing Russian Supplies: Replacing an estimated $26 billion in Russian energy supplies would bring the total annual purchases from the US to approximately $125 billion.

- The Remaining Shortfall: This leaves a gap of roughly $125 billion per year, which would need to be filled by other energy-related trade.

- Uncertain Gap-Fillers: The factsheet suggests additional imports could include energy technology and services, particularly in the nuclear sector (including Small Modular Reactors – SMRs). However, the deployment of SMRs is not immediate, and the total value of such trade is unlikely to bridge the significant financial gap.

Ultimately, achieving the target would require, as one analyst noted, “diplomatic ambiguity, political math and a broad definition of energy,” which may dilute the partnership’s intended impact on global energy security and sustainability.

1. Which SDGs are addressed or connected to the issues highlighted in the article?

The article discusses issues related to energy policy, technology, international trade, and industrial development, which connect to several Sustainable Development Goals (SDGs). The primary SDGs addressed are:

-

SDG 7: Affordable and Clean Energy

The core of the article revolves around energy, specifically the development and deployment of battery energy storage systems, which are crucial for grid stability and integrating renewable energy sources like solar and wind. It also discusses the trade of various energy forms, including LNG, oil, and nuclear fuel.

-

SDG 9: Industry, Innovation, and Infrastructure

The article highlights the push for building resilient infrastructure through energy storage. It delves into industrial policy, focusing on the challenges and growth of domestic manufacturing for batteries and their components in the US to reduce reliance on foreign supply chains, particularly from China.

-

SDG 13: Climate Action

By focusing on clean energy technologies like battery storage, solar, and wind, the article implicitly addresses climate action. It also explicitly mentions a policy change related to CO2 pollution, stating, “The Trump administration has moved to scrap an Obama-era rule on CO₂ pollution by curbing the government’s ability to regulate greenhouse gases,” which directly relates to national climate policies.

-

SDG 17: Partnerships for the Goals

The article extensively discusses international partnerships and trade. This includes the US-EU energy trade deal, the reliance on Chinese supply chains for battery components, and partnerships between US and non-Chinese companies (like South Korea’s LG Energy Solution) to build manufacturing capacity.

2. What specific targets under those SDGs can be identified based on the article’s content?

Based on the article’s discussion, the following specific SDG targets can be identified:

-

SDG 7: Affordable and Clean Energy

- Target 7.2: By 2030, increase substantially the share of renewable energy in the global energy mix. The article discusses how an “earlier phaseout of solar and wind tax credits could also weaken demand for energy storage projects because they are often co-located with those renewable technologies,” linking the viability of battery storage directly to the growth of renewable energy.

- Target 7.a: By 2030, enhance international cooperation to facilitate access to clean energy research and technology, including renewable energy, energy efficiency and advanced and cleaner fossil-fuel technology, and promote investment in energy infrastructure and clean energy technology. The challenges in the US battery supply chain, the reliance on Chinese technology, and partnerships with South Korean firms like LG Energy Solution all point to the dynamics of accessing and developing clean energy technology on a global scale.

-

SDG 9: Industry, Innovation, and Infrastructure

- Target 9.2: Promote inclusive and sustainable industrialization and, by 2030, significantly raise industry’s share of employment and gross domestic product, in line with national circumstances, and double its share in least developed countries. The article details the effort to build up US domestic manufacturing for batteries, noting that “US domestic suppliers are scaling up but Wood Mackenzie estimates that they will only be able to meet 40 per cent of the country’s energy storage demand by 2030.”

- Target 9.4: By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with all countries taking action in accordance with their respective capabilities. The entire discussion on deploying battery energy storage systems to strengthen the US power grid is an example of upgrading critical infrastructure to support a sustainable energy transition.

-

SDG 13: Climate Action

- Target 13.2: Integrate climate change measures into national policies, strategies and planning. The article provides examples of how national policies directly impact climate-related initiatives. The proposed tax policies under Trump and the scrapping of the “Obama-era rule on CO₂ pollution” are direct instances of national policy affecting climate change measures.

-

SDG 17: Partnerships for the Goals

- Target 17.7: Promote the development, transfer, dissemination and diffusion of environmentally sound technologies to developing countries on favourable terms. While the article focuses on developed nations, the theme of technology diffusion is central. The “foreign entity of concern” (FEOC) rules directly impact the transfer and use of Chinese battery technology in the US, affecting the global flow of these environmentally relevant technologies.

- Target 17.11: Significantly increase the exports of developing countries, in particular with a view to doubling the least developed countries’ share of global exports by 2020. The article highlights the opposite dynamic, where a major trade deal is focused on increasing exports from a developed country (the US) to a developed bloc (the EU), as seen in the “$750bn of American energy” deal. It also underscores China’s dominant role as an exporter in the battery supply chain.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

Yes, the article contains several quantitative and qualitative indicators that can be used to measure progress:

-

Indicators for SDG 7 and SDG 9

- Domestic Manufacturing Capacity: “Wood Mackenzie estimates that they [US domestic suppliers] will only be able to meet 40 per cent of the country’s energy storage demand by 2030.” This is a direct indicator of progress towards industrial self-sufficiency (Target 9.2).

- Investment and Capacity Expansion: “South Korea’s LG Energy Solution… plans to expand to 17 gigawatt hours at its Michigan site, aiming for more than 30GW hours by 2026.” This measures investment in clean energy infrastructure (Target 7.a).

- Project Development Status: “16 battery energy storage projects had already been downsized or cancelled this year.” This serves as a negative indicator, showing the impact of policy and market challenges on clean energy deployment (Target 7.2).

- Market Demand Forecasts: An expected “10-20 per cent drop in demand for battery storage through to the end of 2030” due to policy changes serves as an indicator for the health of the clean energy market (Target 7.2).

-

Indicators for SDG 17

- Value of Trade Agreements: The US-EU deal stipulates that “European companies would buy $750bn of American energy over three years,” with a target of “$250bn a year.” This is a clear financial indicator for a bilateral partnership.

- Current Trade Volumes: The article provides a baseline for the US-EU energy trade, stating, “Current import volumes of US LNG, oil, nuclear fuel and fuel services are worth about $90bn-$100bn a year.” This can be used to measure the progress toward the $250bn annual target.

-

Indicators for SDG 13

- Status of Environmental Regulations: The mention that “The Trump administration has moved to scrap an Obama-era rule on CO₂ pollution” is a qualitative indicator of a country’s policy direction regarding climate action and its integration into national planning (Target 13.2).

4. Create a table with three columns titled ‘SDGs, Targets and Indicators” to present the findings from analyzing the article. In this table, list the Sustainable Development Goals (SDGs), their corresponding targets, and the specific indicators identified in the article.

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 7: Affordable and Clean Energy |

7.2: Increase substantially the share of renewable energy.

7.a: Promote investment in energy infrastructure and clean energy technology. |

– Number of battery storage projects downsized or cancelled (16 this year). – Forecasted drop in demand for battery storage (10-20% by 2030). – Planned expansion of battery manufacturing capacity (LG Energy Solution aiming for 30GW hours by 2026). |

| SDG 9: Industry, Innovation, and Infrastructure |

9.2: Promote sustainable industrialization and raise industry’s share of GDP.

9.4: Upgrade infrastructure and retrofit industries to make them sustainable. |

– Percentage of domestic energy storage demand met by domestic suppliers (estimated 40% by 2030). – Deployment of battery energy storage systems for grid stability. |

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies, strategies and planning. |

– Changes in national environmental regulations (scrapping of an Obama-era rule on CO₂ pollution). – Implementation of tax credits or other policies supporting or hindering clean energy projects. |

| SDG 17: Partnerships for the Goals |

17.7: Promote the transfer and diffusion of environmentally sound technologies.

17.11: Significantly increase the exports of developing countries. |

– Financial value of international trade agreements (US-EU deal for $750bn in energy over 3 years). – Baseline value of current energy trade ($90bn-$100bn a year from US to EU). – Impact of trade rules (“foreign entity of concern” rules) on technology supply chains. |

Source: ft.com