Report on the Global Hybrid Solar-Wind Systems Market and its Contribution to Sustainable Development Goals

This report analyzes the Global Hybrid Solar-Wind Systems Market, focusing on its growth trajectory, key segments, and significant alignment with the United Nations Sustainable Development Goals (SDGs). These integrated renewable energy solutions are pivotal in advancing global targets for clean energy, climate action, and sustainable infrastructure.

Executive Summary and Market Projections

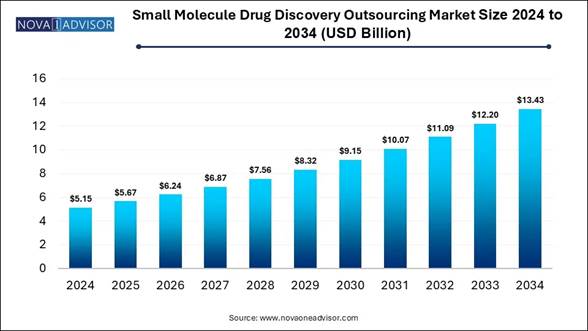

The Global Hybrid Solar-Wind Systems Market is projected to expand from USD 1.2 billion in 2024 to USD 2.3 billion by 2034, demonstrating a Compound Annual Growth Rate (CAGR) of 6.7%. This growth is fundamentally driven by the global imperative to achieve SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action). By combining solar and wind power, these systems provide a stable and continuous supply of clean electricity, reducing dependence on fossil fuels and supporting the transition to a low-carbon economy. The Asia Pacific region currently leads this transition, accounting for a 43.8% market share valued at USD 0.5 billion.

Key Findings Aligned with Sustainable Development

- Market Growth: The projected growth to USD 2.3 billion by 2034 underscores the increasing investment in renewable technologies essential for meeting SDG 7 targets.

- Component Dominance: Solar Photovoltaic (PV) Panels constitute 38.4% of the market, highlighting their cost-effectiveness and efficiency in advancing clean energy access.

- Connectivity Landscape: On-Grid systems hold a 63.1% market share, contributing to SDG 11 (Sustainable Cities and Communities) by integrating renewable energy into urban infrastructure.

- End-Use Leadership: The commercial sector’s 44.2% share reflects a growing corporate commitment to sustainability and reducing carbon footprints, in line with SDG 12 (Responsible Consumption and Production).

- Regional Leadership: The Asia Pacific’s market dominance is propelled by government initiatives aimed at rural electrification and achieving national climate commitments under the Paris Agreement.

Market Segmentation Analysis

Component Analysis: Advancing SDG 7 through Technology

In 2024, Solar Photovoltaic (PV) Panels dominated the market with a 38.4% share. This leadership is attributed to declining costs and rising efficiency, making solar technology a cornerstone for achieving SDG 7. The modularity of PV panels allows for scalable deployment, from small residential units to large commercial installations, enhancing energy reliability and supporting the development of resilient microgrids in remote areas. This directly contributes to providing clean, round-the-clock power, a key objective of sustainable energy infrastructure.

Connectivity Analysis: Supporting Urban and Rural Sustainability

On-grid systems commanded a 63.1% market share in 2024. These systems are crucial for greening existing power grids in urban and semi-urban areas, directly supporting SDG 11. By enabling net metering, they empower consumers to become producers of clean energy, fostering a decentralized energy model. In contrast, stand-alone systems are vital for achieving universal energy access under SDG 7.1, bringing reliable power to off-grid communities and enabling progress in health (SDG 3) and education (SDG 4).

End-Use Analysis: Driving Corporate and Residential Sustainability

The commercial sector was the largest end-user with a 44.2% market share. This adoption is driven by the need for an uninterrupted power supply and a commitment to corporate social responsibility goals aligned with the SDGs. By investing in hybrid systems, businesses reduce operational costs and their environmental impact. The residential and industrial sectors also contribute significantly, driven by the desire for energy independence and resilience against grid instability, furthering the goals of sustainable living and industrialization (SDG 9).

Market Dynamics and Alignment with SDGs

Driving Factors

The primary driver for the market is the increasing demand for a reliable and clean power supply, which is central to SDG 7. Hybrid systems address the intermittency of single-source renewables, ensuring a stable energy flow essential for critical infrastructure like hospitals, schools, and telecommunication towers. This reliability fosters economic development (SDG 8) and improves quality of life, particularly in underserved regions.

Restraining Factors

The high initial installation cost remains a significant barrier, particularly in developing economies, hindering the universal adoption envisioned by SDG 7. Overcoming this requires innovative financing models and international cooperation, as outlined in SDG 17 (Partnerships for the Goals). Government subsidies and public-private partnerships are essential to make these systems financially accessible to a broader population.

Growth Opportunities

A major growth opportunity lies in rural electrification programs across developing nations. Hybrid systems offer a decentralized, cost-effective alternative to extending traditional grid infrastructure. This directly supports SDG 7.1 (universal access to energy) and contributes to poverty alleviation (SDG 1) by creating local economic opportunities and improving living standards in remote communities.

Latest Trends

The integration of smart energy management systems represents a key trend, aligning with SDG 9 (Industry, Innovation, and Infrastructure). These technologies optimize energy generation, storage, and consumption, enhancing the efficiency and reliability of hybrid systems. Smart controls make renewable energy more manageable and accessible, accelerating the transition towards a sustainable energy future.

Regional Analysis: A Global Commitment to Clean Energy

In 2024, the Asia Pacific region dominated the market with a 43.8% share (USD 0.5 billion). This leadership is a direct result of ambitious government policies and large-scale investments aimed at achieving SDG 7 and SDG 13. Countries like India and China are aggressively pursuing rural electrification and deploying hybrid systems to power remote communities and reduce carbon emissions. North America and Europe are also advancing, driven by strong regulatory frameworks for climate action. The Middle East, Africa, and Latin America are emerging as key growth markets, leveraging hybrid solutions to build resilient and sustainable energy infrastructure.

Key Regions and Countries

- North America: United States, Canada

- Europe: Germany, UK, France, Spain, Italy

- Asia Pacific: China, India, Japan, South Korea, Australia

- Latin America: Brazil, Mexico

- Middle East & Africa: GCC, South Africa

Competitive Landscape and Strategic Developments

Key market players are actively contributing to the SDGs through innovation and strategic partnerships. Their efforts are crucial in scaling up the deployment of hybrid systems globally.

Key Player Contributions

- Alpha Devraj Renewable Energy LLP: Focuses on customized systems for rural and off-grid applications, directly addressing energy access challenges and supporting SDG 7.

- Gamesa: Leverages its expertise in wind technology to deliver large-scale hybrid projects, contributing to industrial decarbonization and resilient infrastructure under SDG 9.

- UNITRON Energy System Pvt. Ltd.: Innovates with modular and scalable designs, making clean energy more accessible and affordable for a wider range of users.

- Windstream Energy Technologies: Its SolarMill® hybrid systems are being deployed to electrify remote islands, demonstrating a clear commitment to leaving no one behind.

Recent Developments Highlighting SDG Progress

- April 2025: ONIX Renewable’s planned investment of ₹25,000 crore to develop 7 GW of renewable capacity is a significant step towards achieving national and global clean energy targets (SDG 7).

- April 2024: The partnership between WindStream Energy Technologies and the Philippine National Oil Company to deploy hybrid systems in off-grid islands exemplifies SDG 17 (Partnerships for the Goals) in action, aiming to provide clean energy to remote communities.

Analysis of Sustainable Development Goals (SDGs) in the Hybrid Solar Wind Systems Market

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 7: Affordable and Clean Energy

- The article is centered on hybrid solar-wind systems, which are a form of clean and renewable energy. It directly addresses the global shift towards “sustainable energy infrastructure” and the goal of providing a “stable and continuous power supply” by reducing dependence on fossil fuels like diesel generators.

-

SDG 9: Industry, Innovation, and Infrastructure

- The report highlights the development of “decentralized and sustainable energy infrastructure,” including “microgrids” and “disaster-resilient infrastructure.” It also points to innovation through the “integration of Smart Energy Management System technologies” to improve efficiency and reliability.

-

SDG 11: Sustainable Cities and Communities

- The article mentions the dominance of “On-Grid Systems” which are being installed in “urban and semi-urban areas,” “industrial parks, institutional campuses, and smart cities.” This contributes to making cities more sustainable by promoting cleaner, grid-based power systems.

-

SDG 13: Climate Action

- The text explicitly states that market growth is driven by “Environmental regulations and climate change mitigation policies.” It notes that nations are advancing their commitments to “reduce carbon emissions and transition away from fossil fuel-based energy,” positioning hybrid systems as a key solution.

-

SDG 17: Partnerships for the Goals

- The article provides numerous examples of financial and technological partnerships. These include Adani Green Energy obtaining “$1.06 billion in long-term refinancing,” Tata Power raising “$4.25 billion from the Asian Development Bank,” and WindStream Energy Technologies entering a memorandum of understanding with the Philippine National Oil Company (PNOC). These collaborations are crucial for funding and deploying clean energy projects.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Target 7.1: Ensure universal access to affordable, reliable and modern energy services.

- The article emphasizes that a key driver is the “rising electricity demand in rural areas, where grid extension is technically challenging and economically unfeasible.” It highlights the role of hybrid systems in “expanding rural electrification in developing countries” and providing power to “remote villages and islands” and critical facilities like “rural schools, telecom towers, and healthcare centers.”

-

Target 7.2: Increase substantially the share of renewable energy in the global energy mix.

- The entire article is a testament to this target. It projects the market for hybrid solar-wind systems to grow from “USD 1.2 billion in 2024” to “USD 2.3 billion by 2034.” The development of large-scale projects, such as a “50 MW wind-solar hybrid project” and a “300 MW solar-wind hybrid project,” directly contributes to increasing the share of renewables.

-

Target 7.a: Enhance international cooperation to facilitate access to clean energy research and technology… and promote investment in energy infrastructure and clean energy technology.

- The article details significant international and national financing for clean energy. Examples include Tata Power raising “$4.25 billion from the Asian Development Bank” and Adani Green Energy securing “$1.06 billion” in refinancing, which demonstrates the promotion of investment in clean energy infrastructure.

-

Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure… with a focus on affordable and equitable access for all.

- The development of “decentralized” hybrid systems for “off-grid and remote regions” is a direct effort to build resilient and sustainable infrastructure that provides equitable access to energy where traditional grid infrastructure is absent.

-

Target 13.2: Integrate climate change measures into national policies, strategies and planning.

- The article confirms this by stating that “governments and energy institutions… are actively promoting hybrid systems through supportive policies and clean energy targets” and that “Environmental regulations and climate change mitigation policies are contributing additional momentum.”

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Indicator for Target 7.1 (Access to electricity):

- While not providing a direct percentage, the article implies progress by focusing on “rural electrification programs,” the deployment of systems in “remote, off-grid islands in the Philippines,” and providing power to underserved facilities. The growth of the “Stand-Alone System” market segment is an indirect measure of increasing energy access in off-grid areas.

-

Indicator for Target 7.2 (Share of renewable energy):

- The article provides several quantitative indicators:

- The market value growth from USD 1.2 billion in 2024 to a projected USD 2.3 billion by 2034.

- The Compound Annual Growth Rate (CAGR) of 6.7%.

- The installed capacity of new projects, such as the 50 MW and 300 MW hybrid projects mentioned.

- The article provides several quantitative indicators:

-

Indicator for Target 7.a & 17.3 (Financial flows and investment):

- The article provides specific financial figures that serve as direct indicators of investment mobilization:

- $1.06 billion in refinancing for Adani Green Energy.

- INR 272 crore loan for KPI Green Energy.

- $4.25 billion raised by Tata Power from the Asian Development Bank.

- ₹19.88 billion in financing for ACME Renewtech.

- The article provides specific financial figures that serve as direct indicators of investment mobilization:

-

Indicator for Target 9.1 (Infrastructure development):

- The number and capacity of new infrastructure projects serve as an indicator. The article mentions a “50 MW wind-solar hybrid project in Gujarat” and a “300 MW solar-wind hybrid project,” which are concrete examples of infrastructure development.

-

Indicator for Target 17.7 (Technology transfer):

- The memorandum of understanding between “WindStream Energy Technologies” and the “Philippine National Oil Company (PNOC) to deploy its SolarMill® hybrid wind-solar systems” is a specific example of technology transfer to a developing country.

4. Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators Identified in the Article |

|---|---|---|

| SDG 7: Affordable and Clean Energy | 7.1: Ensure universal access to affordable, reliable and modern energy services. 7.2: Increase substantially the share of renewable energy in the global energy mix. 7.a: Enhance international cooperation and promote investment in clean energy. |

|

| SDG 9: Industry, Innovation, and Infrastructure | 9.1: Develop quality, reliable, sustainable and resilient infrastructure. 9.4: Upgrade infrastructure and retrofit industries to make them sustainable. |

|

| SDG 11: Sustainable Cities and Communities | 11.6: Reduce the adverse per capita environmental impact of cities. |

|

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies, strategies and planning. |

|

| SDG 17: Partnerships for the Goals | 17.3: Mobilize additional financial resources for developing countries. 17.7: Promote the transfer of environmentally sound technologies. |

|

Source: market.us