Hedge Fund Investment Trends Signal a Strategic Pivot Towards Sustainable Development Goals

Executive Summary

A comprehensive analysis of hedge fund investment positions reveals a significant strategic reversal, with funds increasingly divesting from fossil fuels and channeling capital towards renewable energy sectors. This shift in investment strategy directly aligns with and supports the achievement of several United Nations Sustainable Development Goals (SDGs), most notably SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action). Data indicates that since October 2024, hedge funds have predominantly held short positions against oil stocks while simultaneously reducing short bets on solar energy and maintaining long positions in wind energy.

From Fossil Fuels to Renewables: A Shift Supporting Global Climate Action

Declining Confidence in Oil Markets Underscores SDG 13 (Climate Action)

Hedge funds are increasingly betting against the long-term viability of oil stocks, a move that supports the global transition away from carbon-intensive energy sources as mandated by SDG 13. Key factors influencing this trend include:

- Supply and Demand Imbalances: Concerns are growing regarding a potential oversupply of oil, driven by some OPEC+ nations increasing output to protect market share.

- Economic Headwinds: Evidence of economic slowdowns in major economies like the US and China is dampening the demand outlook for oil.

- Policy and Market Volatility: US administration policies aimed at lowering oil prices and the resulting trade volatility have created an unsustainable environment for producers, leading to negative sentiment within the industry.

- Long-Term Price Skepticism: Several funds are shorting oil stocks based on projections of significantly lower oil prices in the coming years, particularly into 2026.

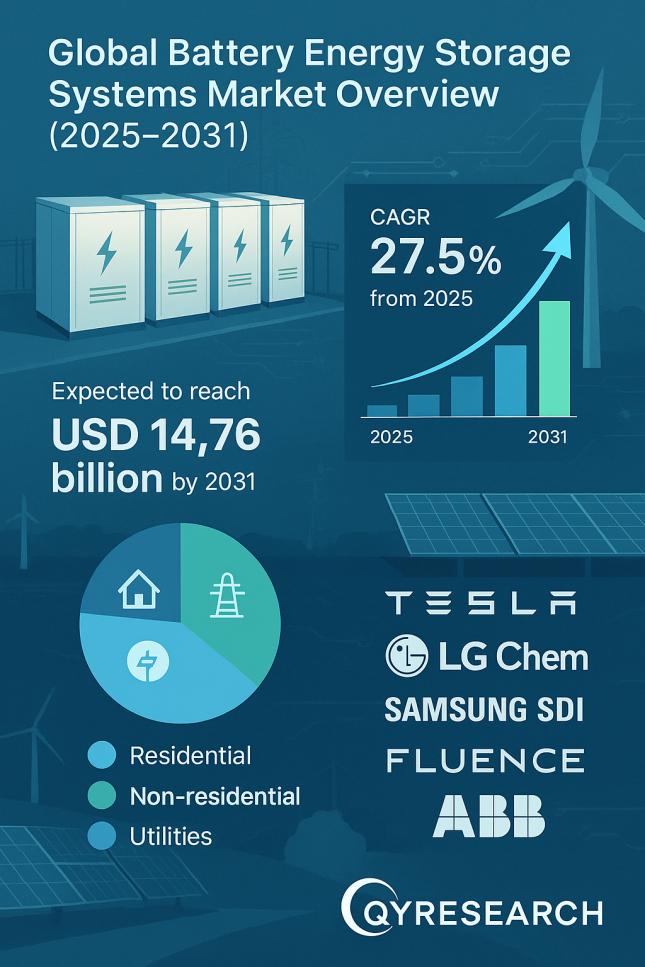

Increased Investment in Renewables Advances SDG 7 (Affordable and Clean Energy)

The move away from oil is coupled with a renewed confidence in the renewable energy sector, directly contributing to the objectives of SDG 7. This is demonstrated by several market indicators:

- Solar Energy Rebound: The average share of funds net shorting stocks in the Invesco Solar ETF fell to 3% in June, its lowest point since April 2021. This indicates a significant unwinding of negative bets and a bottoming-out for clean energy assets.

- Sustained Support for Wind Energy: The number of funds holding net long positions in the First Trust Global Wind Energy ETF reached a 30-month high in February, and net long positions continue to dominate shorts.

- Chinese Green Stock Recovery: After a period of decline, China’s green energy index has advanced approximately 19% from its April low, signaling a recovery driven by the solar industry addressing overcapacity issues.

Key Drivers for a Sustainable Energy Transition

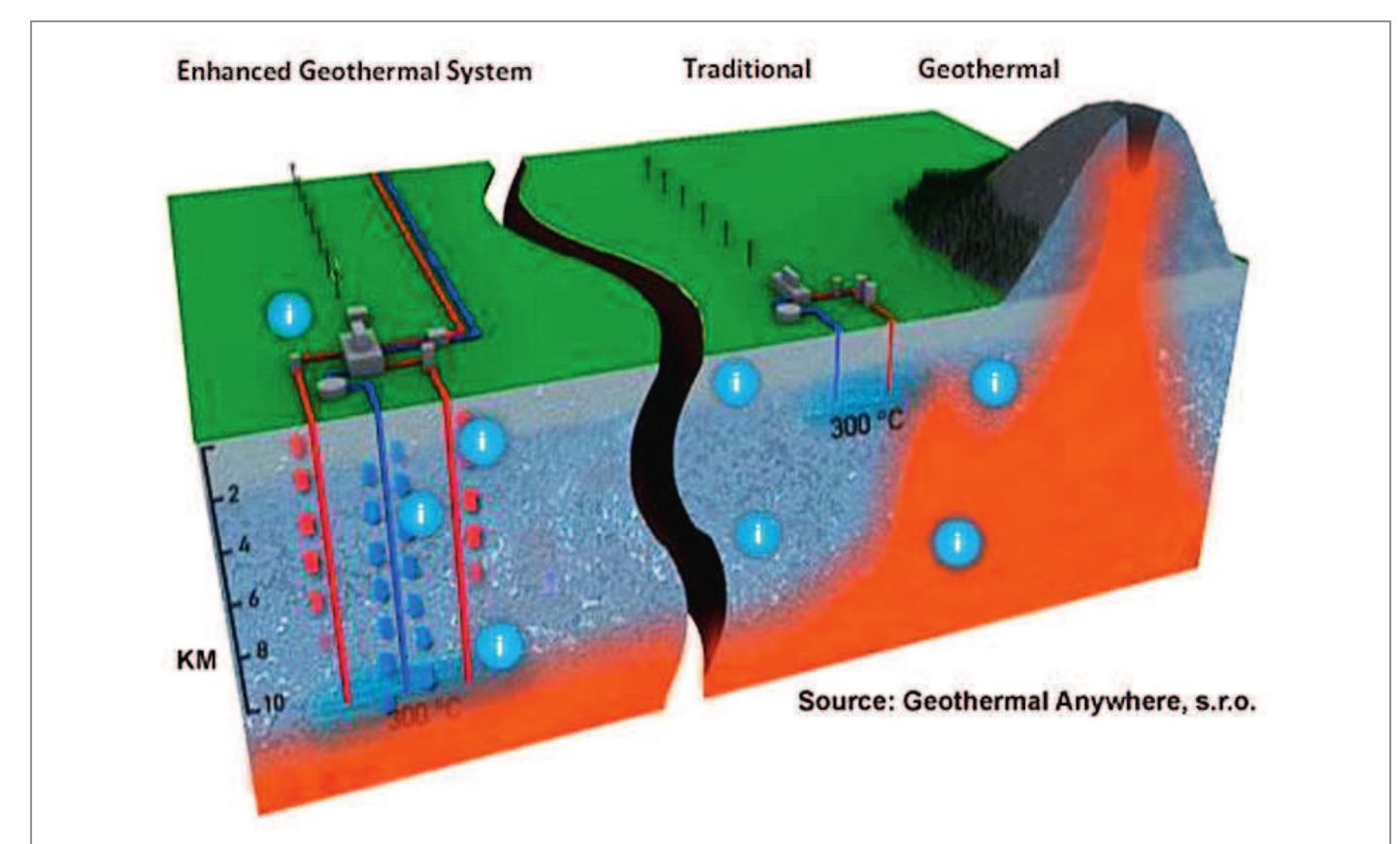

Innovation and Infrastructure for a New Energy Era (SDG 9)

The accelerating energy transition is being propelled by technological advancements, reflecting the principles of SDG 9 (Industry, Innovation, and Infrastructure). A primary driver is the projected surge in energy demand from Artificial Intelligence (AI).

- Market analysis suggests that renewables are critical to meeting this generational swell in energy demand, primarily because they are the “fastest to market.”

- According to BloombergNEF, renewables are expected to fulfill more than half of the additional generation capacity required by 2035, fostering the development of resilient and sustainable infrastructure.

Electric Mobility and Responsible Consumption (SDG 11 & SDG 12)

The global shift towards electric vehicles (EVs) is a critical component of the energy transition, supporting SDG 11 (Sustainable Cities and Communities) and SDG 12 (Responsible Consumption and Production).

- While hedge funds have remained net short on EV stocks, the share of net shorts has dropped to its second-lowest level in nearly five years.

- The continued rise in global EV sales, projected to increase 25% annually, is expected to significantly reduce petroleum consumption.

- BloombergNEF estimates that by 2040, EVs could constitute 40% of vehicles on the road, displacing 19 million barrels of oil demand per day and contributing to more sustainable production and consumption patterns.

Conclusion: A Market-Driven Alignment with Global Sustainability

The strategic pivot observed among hedge funds reflects a fundamental understanding that future economic growth is inextricably linked to low-carbon energy. This market-driven transition away from fossil fuels and towards renewables provides powerful momentum for the global sustainability agenda. The investment trends are a clear endorsement of the financial viability of business models that support SDG 7 (Affordable and Clean Energy), SDG 13 (Climate Action), SDG 9 (Industry, Innovation, and Infrastructure), and SDG 12 (Responsible Consumption and Production).

SDGs Addressed in the Article

SDG 7: Affordable and Clean Energy

This is the most prominent SDG in the article. The entire text revolves around the shift in investment strategies from fossil fuels (oil) to clean energy sources (solar, wind).

- The article details how hedge funds are “betting against oil stocks and winding back shorts on solar,” which directly reflects a market transition towards cleaner energy.

- It discusses the improving outlook for solar and wind stocks, noting that “the average share of funds that were net short stocks in the Invesco Solar ETF dropped to 3% in June,” its lowest since April 2021.

- The text highlights the growing energy demand from new technologies like AI and states that renewables are crucial to meeting it, as they are “the fastest to market.”

SDG 13: Climate Action

The shift from oil to renewables is a fundamental strategy for climate change mitigation. The article’s focus on this transition and the government policies influencing it connects directly to climate action.

- The article discusses how US government policies impact the energy sector, such as the “rollback of Biden-era subsidies” for green energy and the “chaos” caused by trade policies affecting the oil industry. These policies are central to a nation’s climate strategy.

- The investment shift itself, driven by factors like “concerns with regards to supply and demand balance” for oil and the potential of renewables, is a market-based form of climate action.

SDG 9: Industry, Innovation, and Infrastructure

The article touches upon the development of new energy infrastructure and the role of innovation in driving energy demand and supply.

- It mentions investments in “utility-scale solar” and the growth of the electric vehicle (EV) market, with a forecast that “about 40% of vehicles on the road could be electric by 2040.” This represents a significant upgrade of energy and transport infrastructure.

- The text points to AI as a major driver of future energy demand, stating, “AI has the potential to trigger a generational swell in energy demand that is likely to give new support to renewables.” This highlights the link between technological innovation and the need for sustainable infrastructure.

SDG 8: Decent Work and Economic Growth

The economic implications of the energy transition, including market stability, economic growth, and potential job impacts, are discussed.

- The article mentions concerns about an “economic slowdown in the US and China” affecting oil demand.

- It references the potential for job losses in the fossil fuel industry, with one oil industry respondent fearing that policy volatility will drive companies to “lay down rigs.”

* It also points to a new model of growth, noting that “economic growth without low-carbon energy is now inconceivable,” linking future prosperity to the adoption of renewables.

SDG 12: Responsible Consumption and Production

The article discusses the management of energy resources and the shift away from unsustainable production patterns.

- It addresses the oil market’s “supply and demand balance” and the actions of OPEC+ members to preserve market share, which relates to the management of a natural resource.

- The mention of China’s solar industry “addressing overcapacity concerns” is a direct example of managing production patterns to ensure sustainability.

- The forecast that EVs could displace “19 million barrels of oil a day” by 2040 points to a significant shift in consumption patterns away from fossil fuels.

Specific Targets Identified

Under SDG 7 (Affordable and Clean Energy)

- Target 7.2: By 2030, increase substantially the share of renewable energy in the global energy mix. The article is centered on this target, detailing the investment shift from oil to solar and wind. It cites a BloombergNEF report stating, “Renewables are likely to meet more than half of the required additional generation capacity by 2035.”

- Target 7.a: By 2030, enhance international cooperation to facilitate access to clean energy research and technology… and promote investment in energy infrastructure and clean energy technology. The analysis of hedge fund investments (a $700 billion sample) in solar, wind, and EV-related stocks is a direct reflection of financial flows and investment in clean energy technology.

Under SDG 13 (Climate Action)

- Target 13.2: Integrate climate change measures into national policies, strategies and planning. The article explicitly discusses the impact of national policies on the energy transition, such as the “Trump administration attacks on green energy — including a rollback of Biden-era subsidies,” which have “contributed to over $22 billion of clean energy projects being canceled or delayed.”

Under SDG 9 (Industry, Innovation, and Infrastructure)

- Target 9.4: By 2030, upgrade infrastructure and retrofit industries to make them sustainable… with greater adoption of clean and environmentally sound technologies. The article points to this through the rise of EVs, with a forecast of a “25% annual increase in EV sales this year,” and the development of “utility-scale solar.” These are examples of upgrading transport and energy infrastructure with cleaner technologies.

Under SDG 12 (Responsible Consumption and Production)

- Target 12.c: Rationalize inefficient fossil-fuel subsidies that encourage wasteful consumption… While not advocating for it, the article discusses the “rollback of Biden-era subsidies” for green energy and the Trump administration’s policies on fossil fuels. This directly relates to the theme of government subsidies and their impact on energy markets.

Indicators for Measuring Progress

Implied Indicators

The article provides several quantitative data points that can serve as proxies or direct indicators for measuring progress towards the identified targets.

- For Target 7.2 (Share of renewable energy):

- The percentage of hedge funds that are net long or net short stocks in specific clean energy ETFs (e.g., Invesco Solar ETF, First Trust Global Wind Energy ETF) versus fossil fuel indices (S&P Global Oil Index). The article notes the share of funds net short solar stocks dropped to a low of 3% in June.

- The performance of clean energy stock indices. The article mentions the S&P clean energy index has added about 18% since April 2, while the Invesco Solar ETF is up more than 18%.

- Forecasts on renewable capacity, such as “Renewables are likely to meet more than half of the required additional generation capacity by 2035.”

- For Target 9.4 (Adoption of clean technologies):

- The annual growth rate of EV sales, which the article cites as a “25% annual increase in EV sales this year.”

- The projected share of EVs in the total vehicle fleet, cited as “about 40% of vehicles on the road could be electric by 2040.”

- The amount of oil displaced by EVs, estimated to be “19 million barrels of oil a day by that year.”

- For Target 13.2 (Integration of climate policies):

- The monetary value of clean energy projects affected by policy changes. The article provides a figure: “over $22 billion of clean energy projects being canceled or delayed since January” due to policy shifts.

- For Target 7.a (Investment in clean energy):

- The total assets under management (AUM) of the analyzed funds ($700 billion) provide a scale for the financial flows being shifted between energy sectors.

Summary of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators Identified or Implied in the Article |

|---|---|---|

| SDG 7: Affordable and Clean Energy | 7.2: Increase substantially the share of renewable energy in the global energy mix.

7.a: Promote investment in energy infrastructure and clean energy technology. |

|

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies, strategies and planning. |

|

| SDG 9: Industry, Innovation, and Infrastructure | 9.4: Upgrade infrastructure and retrofit industries to make them sustainable… with greater adoption of clean technologies. |

|

| SDG 12: Responsible Consumption and Production | 12.c: Rationalize inefficient fossil-fuel subsidies. |

|

Source: finance.yahoo.com