Report on Corporate Accountability and its Role in Achieving Sustainable Development Goals

Introduction: The Intersection of Accounting and Global Sustainability

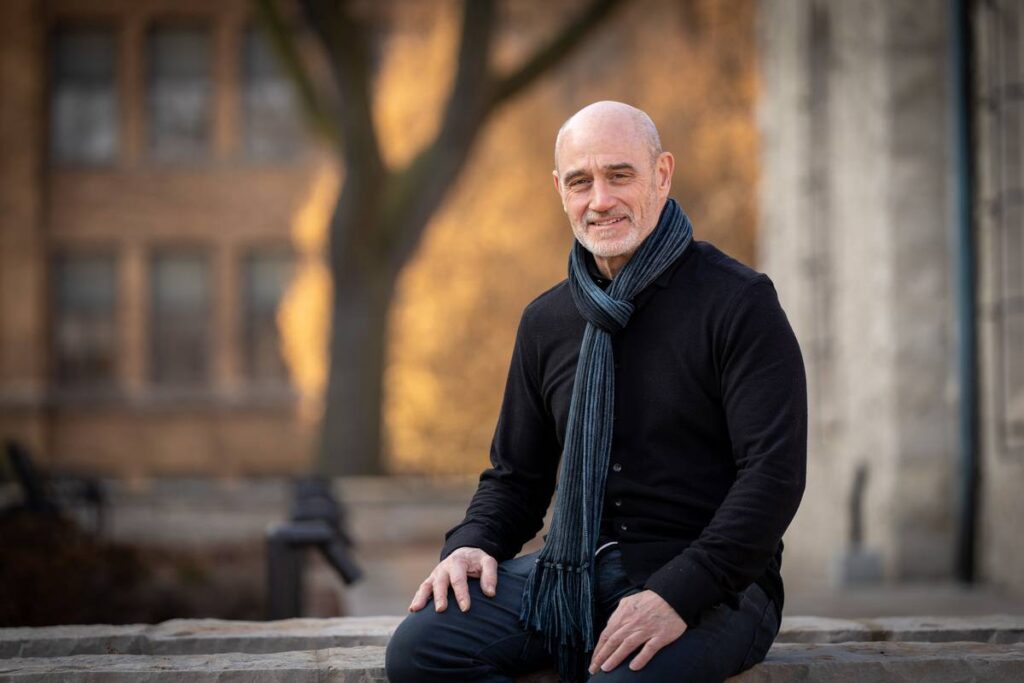

This report examines the research of Professor Yongtae Kim of Santa Clara University, a leading scholar in accounting. His work provides critical insights into how corporate transparency, ethical governance, and Environment, Social, and Governance (ESG) practices are fundamental to achieving the United Nations Sustainable Development Goals (SDGs). The findings underscore that transparent accounting is a primary mechanism for aligning corporate incentives with global sustainability objectives, particularly those related to economic growth, institutional integrity, and responsible production.

Enhancing Corporate Governance for SDG 16: Peace, Justice and Strong Institutions

Professor Kim’s research establishes a direct link between corporate disclosure practices and the development of accountable institutions, a core target of SDG 16. By analyzing the behavioral and economic impacts of transparency, his work demonstrates how robust accounting standards contribute to a more just and ethical corporate ecosystem.

The Impact of ESG Disclosure Mandates

Mandatory ESG disclosures compel corporations to be accountable not only to shareholders but also to society, thereby strengthening institutional integrity. The research highlights several key outcomes that support SDG 16:

- Increased Transparency: ESG reporting requires firms to disclose information on their environmental and social impact, reducing information asymmetry and holding management accountable.

- Building Public Trust: Transparent reporting on ethical practices helps firms earn public trust, a cornerstone of strong and reliable institutions.

- Combating Corruption: By scrutinizing corporate behavior, ESG frameworks discourage unethical practices such as tax avoidance and earnings manipulation, which undermine public finances and trust.

The Role of Auditing in Upholding Ethical Standards

The report notes the critical function of independent auditors in verifying corporate data and assessing risk. An auditor’s perception of executive attitudes toward financial reporting directly influences the rigor of their audit. This process is essential for ensuring that corporations operate honestly, thereby preventing the erosion of institutional integrity that harms progress toward the SDGs.

Economic Growth and Responsible Production: Contributions to SDG 8 and SDG 12

The research proves a clear financial case for ethical corporate conduct, linking ESG principles to sustainable economic benefits. This alignment is crucial for advancing SDG 8 (Decent Work and Economic Growth) and SDG 12 (Responsible Consumption and Production).

Financial Dividends of Ethical Practices

Companies demonstrating a commitment to ethical values and ESG principles realize tangible financial advantages. These benefits create a market incentive for sustainable behavior, fostering the kind of economic growth envisioned in SDG 8.

- Lower Borrowing Costs: Financial institutions view transparent, ethically-governed companies as less risky, resulting in more favorable lending terms.

- Increased Investment: Investors are increasingly attracted to firms with strong ESG credentials, seeing them as more resilient and valuable in the long term.

- Enhanced Corporate Culture: A commitment to transparency reshapes internal culture, leading to decisions that support long-term stability over short-term gains.

Countering ‘Greenwashing’ for Responsible Production

Professor Kim’s work addresses the growing consumer and investor vigilance against ‘greenwashing,’ where corporations use superficial social initiatives to distract from harmful core practices. True ESG transparency, as advocated in his research, supports SDG 12 by ensuring that corporate claims of sustainability are backed by verifiable data and genuine operational changes, promoting truly responsible production patterns.

Fostering Future Leaders for Sustainable Development: A Focus on SDG 4

A significant component of achieving the SDGs involves education. The report highlights Professor Kim’s pedagogical approach, which is centered on preparing the next generation of business leaders to integrate ethical considerations into corporate strategy, directly contributing to SDG 4 (Quality Education), particularly target 4.7 concerning education for sustainable development.

Integrating Ethics and Sustainability into Business Education

By teaching students to embody values of transparency and responsibility, higher education can be the most effective channel for improving corporate reporting and ethical conduct. Professor Kim’s curriculum at the Leavey School of Business prepares students to navigate complex ethical challenges in the financial industry.

Addressing Modern Technological and Ethical Challenges

The curriculum addresses contemporary issues that have significant implications for the SDGs, including:

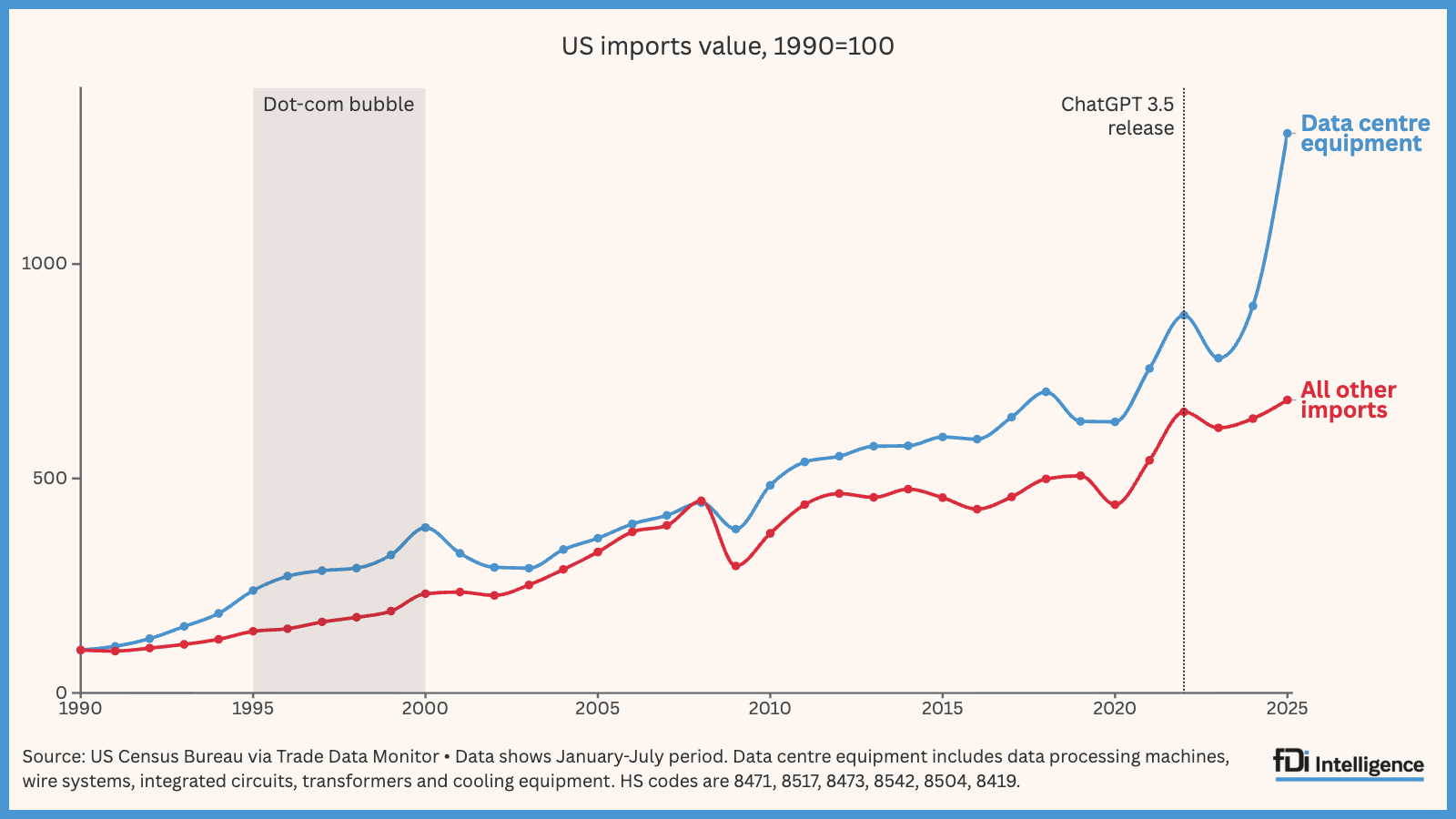

- Artificial Intelligence: Examining the ethical dilemmas of AI, including data privacy, undervalued labor in machine learning, and inflated valuations, which relate to SDG 8 and SDG 16.

- Digital Assets and Blockchain: Understanding the transparency and accountability challenges in emerging financial technologies.

- Financial Forensics: Equipping students with the skills to identify and address financial manipulation and fraud, strengthening institutional accountability.

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

- SDG 4: Quality Education – The article emphasizes the role of education in shaping ethical business leaders. It highlights Yongtae Kim’s belief that teaching students at the Leavey School of Business about ethics and responsibility is the “best way to improve transparency in corporate reporting overall.”

- SDG 8: Decent Work and Economic Growth – The article discusses the impact of AI on the accounting industry, noting that some firms are “cutting new hires by half.” It also touches upon the ethical dimension of labor, mentioning the “outsourced and underpaid human labor that underpins the behind-the-scenes machine learning work” for AI.

- SDG 9: Industry, Innovation, and Infrastructure – The text explores the challenges of integrating new technologies like AI ethically. It questions the valuation of AI companies without public disclosure and points to the need for “sustainable innovation” rather than “short-lived hype.”

- SDG 12: Responsible Consumption and Production – This is a central theme. The article’s focus on Environment, Social, and Governance (ESG) practices, transparent accounting, and avoiding ‘greenwashing’ directly relates to encouraging companies to adopt sustainable practices and report on them.

- SDG 16: Peace, Justice, and Strong Institutions – The article extensively discusses the need for corporate accountability and transparency to build public trust. It addresses issues like tax avoidance, hiding financial losses, and the need for independent auditors to act as “watchdogs” rather than “salespeople,” all of which contribute to building effective and accountable institutions.

- SDG 17: Partnerships for the Goals – The article implies the importance of policy and regulation in driving corporate change. It mentions that companies win more foreign government contracts “following an ESG disclosure mandate in their home country,” showing how national policies can have an international impact on promoting sustainable practices.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

SDG 4: Quality Education

- Target 4.7: Ensure that all learners acquire the knowledge and skills needed to promote sustainable development. The article directly supports this by describing how Professor Kim’s teaching aims to “get new managers to be more ethical and responsible” and to embody “the values of Jesuit leadership,” thereby promoting sustainable and transparent corporate practices.

-

SDG 12: Responsible Consumption and Production

- Target 12.6: Encourage companies, especially large and transnational companies, to adopt sustainable practices and to integrate sustainability information into their reporting cycle. The article’s entire focus on Kim’s research into ESG practices is about this target. It states his work “continues to shape how firms earn public trust and deepen their long-term value through transparent accounting and auditing processes.”

-

SDG 16: Peace, Justice, and Strong Institutions

- Target 16.5: Substantially reduce corruption and bribery in all their forms. The article addresses this by discussing unethical corporate behavior such as “tax avoidance strategies, and even hiding losses.” Promoting transparency through ESG disclosures is presented as a way to combat these practices.

- Target 16.6: Develop effective, accountable and transparent institutions at all levels. The article focuses on making corporate institutions more accountable. It states that when firms know their decisions will be scrutinized, “they are less likely to manipulate earnings, avoid taxes, or take shortcuts that erode public trust.”

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

For Target 12.6:

- Indicator: The number of companies disclosing ESG practices or publishing sustainability reports. The article is predicated on the existence of such disclosures, as Kim’s research analyzes the effects of “an ESG disclosure mandate.”

-

For Target 16.5:

- Indicator: Reduction in corporate tax avoidance. The article explicitly mentions “tax avoidance” as a harmful practice that transparency can help mitigate. Measuring changes in corporate tax payments relative to earnings could serve as an indicator.

- Indicator: Frequency of earnings manipulation. The article notes that increased scrutiny makes companies “less likely to manipulate earnings,” implying that the rate of such manipulation is a measurable outcome.

-

For Target 16.6:

- Indicator: Corporate borrowing costs. The article provides a direct financial metric, stating that companies demonstrating ethical values through ESG disclosures “tend to face lower borrowing costs.”

- Indicator: Level of favorable investment. The article also states that transparent companies “attract more favorable investment because investors see them as less risky,” which can be measured.

- Indicator: Public trust in corporations. The article repeatedly mentions that transparency helps companies “earn public trust” and avoid actions that “erode public trust.” This could be measured through public surveys.

SDGs, Targets, and Indicators Table

| SDGs | Targets | Indicators (Mentioned or Implied in the Article) |

|---|---|---|

| SDG 4: Quality Education | 4.7: Ensure all learners acquire knowledge and skills for sustainable development. | Number of business students educated on ethics, responsibility, and transparency in corporate reporting. |

| SDG 12: Responsible Consumption and Production | 12.6: Encourage companies to adopt sustainable practices and integrate sustainability information into their reporting cycle. | The number of companies adhering to ESG disclosure mandates and publishing sustainability reports. |

| SDG 16: Peace, Justice, and Strong Institutions | 16.5: Substantially reduce corruption and bribery in all their forms. | – Reduction in corporate tax avoidance. – Frequency of corporate earnings manipulation. |

| 16.6: Develop effective, accountable and transparent institutions at all levels. | – Lower borrowing costs for companies with high ESG scores. – Level of favorable investment in transparent companies. – Level of public trust in corporations. |

Source: scu.edu