Report on the Child and Dependent Care Tax Credit (CDCTC) and its Alignment with Sustainable Development Goals

The Child and Dependent Care Tax Credit (CDCTC) is a key fiscal policy designed to support working families by mitigating the cost of child care. This report analyzes the structure of the CDCTC, its recent legislative updates, and its significant contributions to achieving several United Nations Sustainable Development Goals (SDGs).

Overview of the CDCTC Mechanism

The CDCTC provides financial relief to working families, with an estimated 5.7 million families utilizing the credit in 2022. The value of the credit for an individual family is determined by a combination of factors:

- Household income level

- Number of dependent children

- Tax filing status (e.g., single or joint)

- Total child care expenses incurred, with claimable limits set at $3,000 for one child and $6,000 for two or more children.

Alignment with Sustainable Development Goals (SDGs)

The CDCTC framework directly supports progress toward multiple SDGs by addressing economic and social barriers faced by working families.

- SDG 1: No Poverty

By allowing families to retain a larger portion of their earnings, the CDCTC directly alleviates financial burdens. This increases disposable income for essential needs, acting as a critical tool in poverty reduction strategies for households with dependent care costs. - SDG 5: Gender Equality

The high cost of child care is a significant barrier to female participation in the labor force. The CDCTC promotes gender equality by making child care more affordable, thereby empowering women to pursue and maintain employment, fostering economic independence and career advancement. - SDG 8: Decent Work and Economic Growth

The credit enables parents and guardians to remain in or enter the workforce, contributing to a stable and productive labor market. This support for working families is essential for sustained and inclusive economic growth. - SDG 10: Reduced Inequalities

The CDCTC is structured to provide progressive benefits, with the credit amount often inversely related to income. This design helps reduce economic inequality by providing targeted financial relief to low- and middle-income families, who bear the heaviest proportional burden of child care costs.

Key Policy Developments and Updated Credit Structures

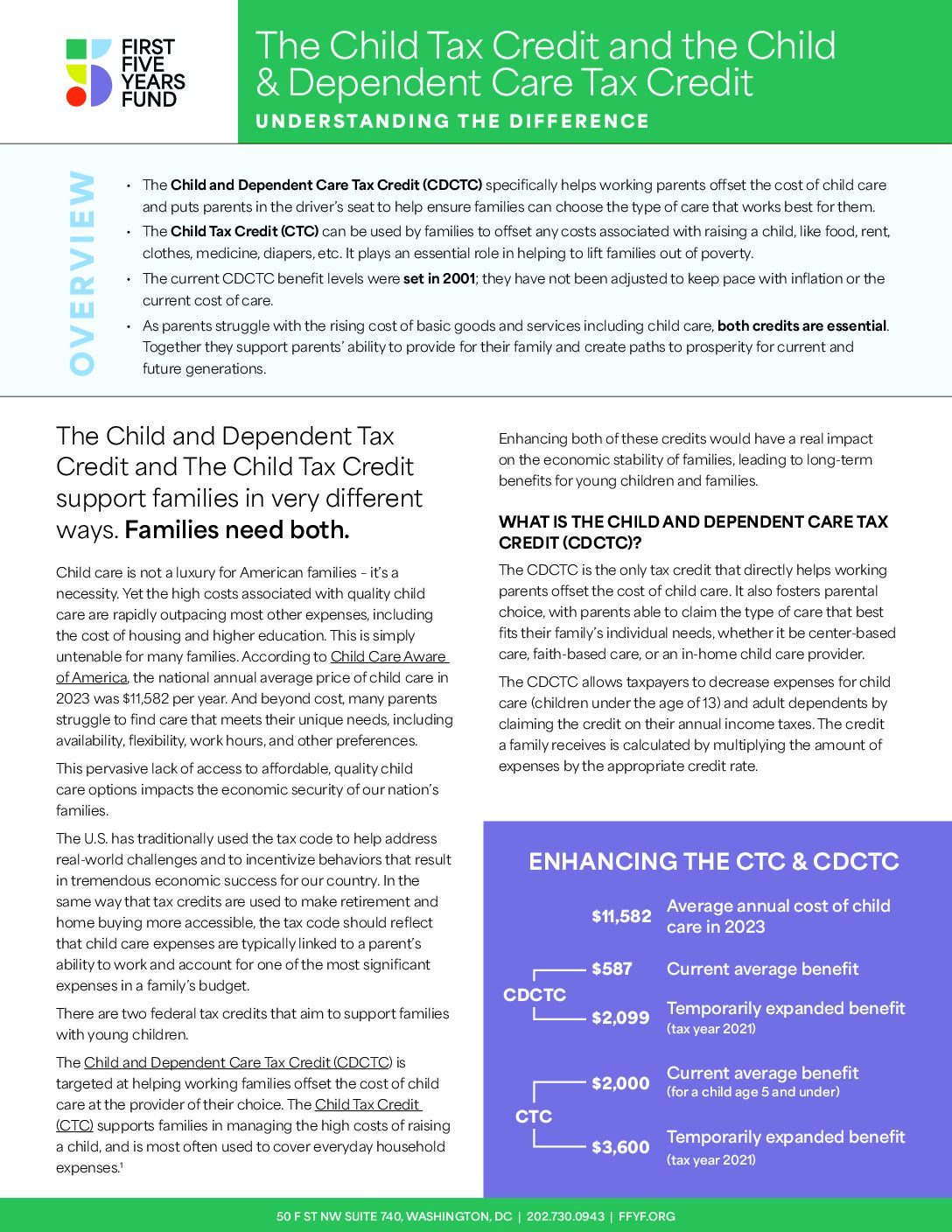

The original credit rates for the CDCTC, established in 2001, were revised in 2025 under the tax reconciliation package H.R.1. This legislative update increased the potential tax break for eligible families. The revised maximum credit amounts are detailed based on filing status.

Maximum Credit Amounts by Filing Status

The updated credit schedules provide specific calculations for different household structures to ensure equitable support.

Single Filers

Updated credit amounts are available for parents who file taxes as single individuals.

Joint Filers

Updated credit amounts are available for married couples who file taxes jointly.

Analysis of the Article in Relation to Sustainable Development Goals (SDGs)

1. Which SDGs are addressed or connected to the issues highlighted in the article?

SDG 1: No Poverty

The article connects to SDG 1 by discussing the Child and Dependent Care Tax Credit (CDCTC), a financial mechanism designed to alleviate economic burdens on working families. By allowing families to “keep more of what they earn to pay for child care,” the policy directly addresses household financial stability, which is a key factor in preventing and reducing poverty.

SDG 5: Gender Equality

The CDCTC is relevant to SDG 5 as the high cost of child care disproportionately affects women’s ability to participate in the labor force. By making child care more affordable, the tax credit helps remove a significant barrier that often forces women to leave their jobs or reduce their working hours, thereby promoting women’s economic empowerment and participation.

SDG 8: Decent Work and Economic Growth

The article highlights that the CDCTC supports “working families.” Access to affordable child care is a critical component for ensuring parents can maintain employment. This policy, therefore, contributes to achieving full and productive employment by enabling caregivers to participate in the workforce, which in turn fuels economic growth.

SDG 10: Reduced Inequalities

The CDCTC addresses SDG 10 as it is a fiscal policy designed to reduce financial inequality. The article states that a family’s credit is dependent on their “income,” implying that the benefit is scaled to provide greater support to those with lower earnings. This progressive structure helps to redistribute resources and reduce the economic gap between different income levels.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

SDG 1: No Poverty

- Target 1.3: “Implement nationally appropriate social protection systems and measures for all, including floors, and by 2030 achieve substantial coverage of the poor and the vulnerable.” The CDCTC is a clear example of a nationally implemented social protection system delivered through the tax code to provide financial relief to families with caregiving expenses.

-

SDG 5: Gender Equality

- Target 5.4: “Recognize and value unpaid care and domestic work through the provision of public services, infrastructure and social protection policies…” The CDCTC is a social protection policy that helps families afford formal care services, thereby recognizing the economic cost of care and supporting parents (often women) to engage in paid employment.

-

SDG 8: Decent Work and Economic Growth

- Target 8.5: “By 2030, achieve full and productive employment and decent work for all women and men…” By reducing the cost of child care, the CDCTC acts as a tool to support labor force participation, helping parents, especially women, to secure and maintain employment.

-

SDG 10: Reduced Inequalities

- Target 10.4: “Adopt policies, especially fiscal, wage and social protection policies, and progressively achieve greater equality.” The CDCTC is a specific fiscal policy designed as a social protection measure. Its income-dependent structure is a direct mechanism aimed at achieving greater financial equality among working families.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

Yes, the article mentions several quantitative and qualitative indicators that can be used to measure progress.

-

Number of Beneficiaries

The article states that “An estimated 5.7 million families claimed the CDCTC in 2022.” This figure serves as a direct indicator for Target 1.3, measuring the coverage of this social protection system.

-

Financial Support Levels

The article specifies the maximum claimable expenses: “families can claim up to $3,000 for one child and $6,000 for two or more children.” These amounts, along with the credit rates detailed in the charts for single and joint filers, are indicators for Target 10.4, as they quantify the level of fiscal support provided to reduce inequality.

-

Policy Implementation and Updates

The mention of the credit rates being “increased” in 2025 as part of a tax reconciliation package is an indicator of policy adoption and enhancement, relevant to Targets 1.3, 5.4, and 10.4. It shows an active effort to strengthen social protection policies.

-

Factors Determining Credit

The four factors listed—”income, number of children, filing status… and child care expenses”—are themselves indicators of how the policy is structured to target specific needs and promote equality, which is relevant for Target 10.4.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 1: No Poverty | 1.3: Implement nationally appropriate social protection systems. | Number of families claiming the CDCTC (5.7 million in 2022). |

| SDG 5: Gender Equality | 5.4: Recognize and value unpaid care work through social protection policies. | Existence and updates to the CDCTC policy, which makes child care more affordable and enables workforce participation. |

| SDG 8: Decent Work and Economic Growth | 8.5: Achieve full and productive employment for all. | The policy’s support for “working families,” which helps remove barriers to employment. |

| SDG 10: Reduced Inequalities | 10.4: Adopt fiscal and social protection policies to achieve greater equality. |

|

Source: ffyf.org