Report on Fiscal Policy for Advancing Sustainable Development Goals on Gender Equality and Economic Inclusion

Introduction: Addressing Economic Disparities to Achieve SDGs

Significant and persistent economic gaps between men and women undermine progress towards several Sustainable Development Goals (SDGs). These disparities, particularly in income and employment, directly challenge the achievement of SDG 5 (Gender Equality), SDG 1 (No Poverty), SDG 8 (Decent Work and Economic Growth), and SDG 10 (Reduced Inequalities). The root causes of these gaps are multifaceted and include:

- A disproportionate concentration of women in lower-income households.

- A higher burden of unpaid care and domestic work, which limits time for education and paid employment, impacting SDG 4 (Quality Education) and SDG 5.

- Prevalence in vulnerable, low-wage, or non-permanent employment conditions, hindering progress on SDG 8.

- Systemic barriers embedded in legal rights and social norms.

Effective fiscal policy is a critical tool for targeting these underlying causes and accelerating progress on the SDGs. Policies must be designed to facilitate women’s access to quality employment while simultaneously reducing income poverty and inequality.

A Holistic Fiscal Policy Framework for Sustainable Development

A holistic approach to fiscal policy, integrating tax and social spending measures, is essential for creating a balanced system that advances SDG targets. This approach ensures that individual policies complement each other to achieve redistribution, revenue generation, and positive economic incentives. Fiscal incidence analysis demonstrates that combined tax and social spending measures can reduce income inequality, but their impact varies based on policy design and context. The objective is to create an equitable and efficient fiscal system that finances public goods and services necessary for inclusive, sustainable growth, in line with SDG 17 (Partnerships for the Goals), particularly its focus on domestic resource mobilization.

Tax Systems to Support Gender Equality and Reduce Inequality (SDG 5 & SDG 10)

Gender-equitable tax policies are foundational to achieving a fairer distribution of resources. Key principles and policy options include:

- Progressive Personal Income Tax (PIT): Comprehensive PIT systems that tax all income sources equally, including capital and labor income, are more effective at reducing gender income gaps and overall inequality. Aligning top marginal PIT rates with Corporate Income Tax (CIT) rates can prevent income sheltering and enhance fairness.

- Minimizing Work Disincentives: Tax systems should be designed to avoid penalizing low-wage or secondary earners, a group in which women are overrepresented. This supports women’s labor force participation, contributing to SDG 8.

- Broad-Based Indirect Taxation: While consumption taxes like VAT are efficient for revenue generation (supporting SDG 17), their regressive effects must be mitigated. Rather than using poorly targeted exemptions, a broad base with a uniform rate should be paired with targeted cash transfers to protect low-income households.

- Enhanced Tax Administration: Improving compliance and the efficiency of tax and customs administration is crucial, especially in low-income countries, to maximize revenue available for social spending on key SDGs.

Social Spending as a Catalyst for SDG Achievement

Targeted social spending is a powerful instrument for directly addressing poverty and gender inequality, with significant impacts on multiple SDGs.

Key Social Spending Instruments

- Cash Transfers: Non-contributory, poverty-targeted cash transfers are highly effective in reducing poverty (SDG 1) and can empower women when targeted at the individual level (SDG 5).

- Investment in Human Capital: Spending on public health and education is a primary driver of fiscal redistribution in lower-income countries, directly advancing SDG 3 (Good Health and Well-being) and SDG 4 (Quality Education) and creating long-term opportunities for women and girls.

- Support for Care Work: Policies such as subsidized childcare and gender-neutral paid parental leave can reduce the burden of unpaid care work, lowering a key barrier to women’s participation in the formal labor market (SDG 5 and SDG 8).

- Infrastructure Investment: In low-income contexts, enhancing infrastructure for services like clean water and sanitation reduces time spent on unpaid domestic tasks, contributing to SDG 6 (Clean Water and Sanitation) and freeing up time for economic and educational pursuits.

The Way Forward: Evidence-Based Policy for SDG Implementation

To design and implement effective fiscal policies that advance the SDGs, a robust foundation of data, analysis, and institutional capacity is required. This aligns with the principles of accountability and evidence-based policymaking central to SDG 17.

Strengthening Data and Analytical Capacity (SDG 17)

A primary obstacle to effective policy design is the lack of quality, sex-disaggregated data and analytical capacity, particularly in low- and middle-income countries. To overcome this, the following actions are essential:

- Invest in Data Collection: Governments must prioritize the collection of timely and reliable microdata from household surveys and administrative records. Combining these sources provides a granular understanding of socio-economic disparities and the differential impacts of policies on women and men.

- Develop Analytical Tools: Investment in methods and modeling, such as distributional analysis and microsimulation models (e.g., SOUTHMOD), is critical. These tools enable policymakers to assess the poverty and distributional impacts of fiscal reforms before implementation, ensuring they are aligned with SDG targets for equality and poverty reduction.

- Promote Integrated Policymaking: Tax and social spending policies are often designed in silos. A holistic approach requires breaking down these barriers to develop coordinated reform packages that effectively address the complex and interconnected drivers of gender inequality.

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

The article addresses several Sustainable Development Goals (SDGs) by focusing on the use of fiscal policy to tackle gender inequality and poverty. The primary SDGs connected to the article’s themes are:

-

SDG 5: Gender Equality

This is the central theme of the article. It directly discusses the “significant and persistent income and employment gaps” between men and women, the disproportionate burden of “unpaid work” on women, and how fiscal policies can be designed to “best target the underlying causes of these gender inequalities.”

-

SDG 10: Reduced Inequalities

The article is fundamentally about reducing inequality, stating that fiscal policy can “play a key role in reducing income inequality and poverty—including between men and women.” It analyzes how progressive taxation and social spending can create a “more equitable, efficient fiscal system as a whole.”

-

SDG 1: No Poverty

The text repeatedly links gender inequality with poverty, noting that “there are more women in lower-income households.” It advocates for policies like “targeted cash transfers to support low-income or vulnerable groups” and assesses how fiscal measures can be effective in “reducing income poverty.”

-

SDG 8: Decent Work and Economic Growth

The article connects gender equality to economic outcomes, highlighting that women are less likely to be in “permanent and full-time employment” and more likely to be in “vulnerable employment conditions.” It argues that addressing these gaps can “foster economic growth” and that successful policies should “facilitate women to access and keep quality and well-paid employment.”

-

SDG 3 (Good Health and Well-being) & SDG 4 (Quality Education)

The article points to the need for investment in human capital in low-income countries, specifically through “investment in human capital (health and education spending) for all” as a way to narrow gender gaps in opportunities.

-

SDG 6: Clean Water and Sanitation

While not a primary focus, this goal is referenced as a key area for infrastructure investment to reduce women’s unpaid work. The article mentions the need for “enhancing infrastructure that reduces time involved in unpaid work, like fetching water, or accessing key services, such as walking to sanitation facilities.”

2. What specific targets under those SDGs can be identified based on the article’s content?

Based on the issues discussed, the following specific SDG targets are relevant:

-

Target 10.4: Adopt policies, especially fiscal, wage and social protection policies, and progressively achieve greater equality.

The entire article is an analysis of this target, focusing on how “fiscal policy can play a key role in reducing income inequality” and how “tax and social spending taken together… reduces within-country income inequality.”

-

Target 5.4: Recognize and value unpaid care and domestic work through the provision of public services, infrastructure and social protection policies.

The article directly addresses this by identifying that women “perform a higher share of unpaid work” and recommends policies such as “improving provision of care for children and the elderly,” parental leave, and “enhancing infrastructure that reduces time involved in unpaid work, like fetching water.”

-

Target 8.5: By 2030, achieve full and productive employment and decent work for all women and men… and equal pay for work of equal value.

The article highlights the “income and employment gaps” and the fact that women are less likely to be in “permanent and full-time employment.” It advocates for policies that “facilitate women to access and keep quality and well-paid employment.”

-

Target 1.3: Implement nationally appropriate social protection systems and measures for all… and achieve substantial coverage of the poor and the vulnerable.

The text discusses the importance of “social spending (cash transfers…)” and “social safety nets (SSNs)” as effective tools for poverty reduction, especially when they are “targeted cash transfers to support low-income or vulnerable groups.”

-

Target 5.a: Undertake reforms to give women equal rights to economic resources, as well as access to ownership and control over… property.

The article mentions existing “gaps in a wide array of legal rights and protection” and “asset ownership” between men and women as underlying causes of economic inequality.

-

Target 4.5: By 2030, eliminate gender disparities in education and ensure equal access to all levels of education.

This is referenced in the context of low-income countries, where the article suggests a “greater urgency to narrow gender gaps in opportunities through investment in… education spending.”

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

Yes, the article mentions or implies several indicators that can be used to measure progress:

-

Gender gaps in income and employment:

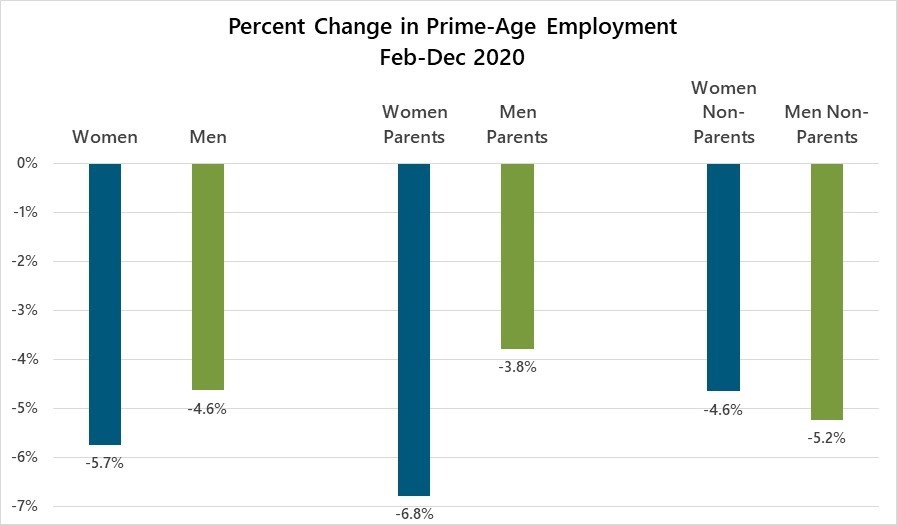

This is an explicit indicator mentioned in the first sentence: “significant and persistent income and employment gaps remain between men and women.” This can be used to measure progress towards targets 8.5 and 10.4.

-

Time spent on unpaid care and domestic work:

The article implies this indicator by stating that women “perform a higher share of unpaid work” and that infrastructure investments can reduce “time involved in unpaid work, like fetching water.” This is a direct measure for target 5.4.

-

Proportion of women in vulnerable employment:

The text states that women are “more likely to be second and low-wage earners or own-account workers under vulnerable employment conditions.” Tracking this proportion would be an indicator for target 8.5.

-

Coverage of social protection benefits:

The discussion of “cash transfers” and “social safety nets (SSNs)” implies the need to measure their reach and effectiveness, particularly for low-income and vulnerable groups, which aligns with measuring progress for target 1.3.

-

Progressivity of tax and benefit systems:

The article repeatedly discusses the importance of “progressivity of direct taxation and social spending.” The level of progressivity can be calculated and used as an indicator for target 10.4.

-

Availability of sex-disaggregated data:

The article explicitly calls for better data, stating the need to “include sex-disaggregated data, to unlock the potential to gain a much deeper understanding of gender-related gaps.” The availability and quality of such data is a crucial process indicator for monitoring all gender-related targets.

4. SDGs, Targets and Indicators Identified in the Article

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 5: Gender Equality | 5.4: Recognize and value unpaid care and domestic work. 5.a: Give women equal rights to economic resources and ownership. |

– Time spent on unpaid care and domestic work (e.g., fetching water). – Gaps in asset ownership between men and women. |

| SDG 10: Reduced Inequalities | 10.4: Adopt fiscal, wage and social protection policies to achieve greater equality. | – Gender gaps in income. – Progressivity of the tax and benefit system. |

| SDG 8: Decent Work and Economic Growth | 8.5: Achieve full and productive employment and decent work for all women and men. | – Gender gaps in employment. – Proportion of women in vulnerable employment vs. permanent, full-time employment. |

| SDG 1: No Poverty | 1.3: Implement social protection systems for the poor and vulnerable. | – Coverage of social protection benefits (e.g., cash transfers, SSNs) for low-income groups. |

| SDG 4: Quality Education | 4.5: Eliminate gender disparities in education. | – Public spending on education aimed at narrowing gender gaps. |

| SDG 6: Clean Water and Sanitation | 6.1 & 6.2: Achieve universal access to water and sanitation. | – Access to infrastructure that reduces time spent fetching water or accessing sanitation facilities. |

Source: brookings.edu