Report on the Link Between Financial Literacy and Sustainable Economic Development

Introduction: Financial Literacy as a Foundation for Sustainable Development Goals (SDGs)

Recent analysis underscores the critical role of financial literacy in achieving global economic stability and inclusive growth, directly aligning with several key Sustainable Development Goals (SDGs). A report from the Centre for Economics and Business Research (CEBR), commissioned by Principal Financial Group, establishes a direct correlation between enhanced financial literacy, reduced loan defaults, and accelerated Gross Domestic Product (GDP) growth. This positions financial education as an essential tool for advancing SDG 8 (Decent Work and Economic Growth), SDG 1 (No Poverty), and SDG 4 (Quality Education).

Key Findings on Economic Impact

Monetary Policy Effectiveness and Individual Financial Health

Isabel Schnabel of the European Central Bank has argued that effective monetary policy relies on a financially literate populace. Individuals who understand core financial concepts such as inflation and interest rates are better equipped to make informed decisions regarding borrowing, spending, and investment. This responsiveness contributes to a more stable economic environment, a prerequisite for achieving SDG 8.

Quantitative Link to Loan Defaults and GDP Growth

The CEBR report provides quantitative evidence supporting the economic benefits of financial literacy, which are central to fostering sustainable economic conditions.

- Reduced Loan Defaults: A 1 percentage point improvement in national financial literacy levels is associated with a 2.78 point decrease in household loan default rates. This contributes to household financial stability, a key component of SDG 1 (No Poverty).

- Boosted GDP Growth: A 10-point increase in financial literacy scores can potentially add 0.3 percentage points to GDP growth over a four-year period, directly supporting the targets of SDG 8 (Decent Work and Economic Growth).

Global Financial Inclusion Landscape

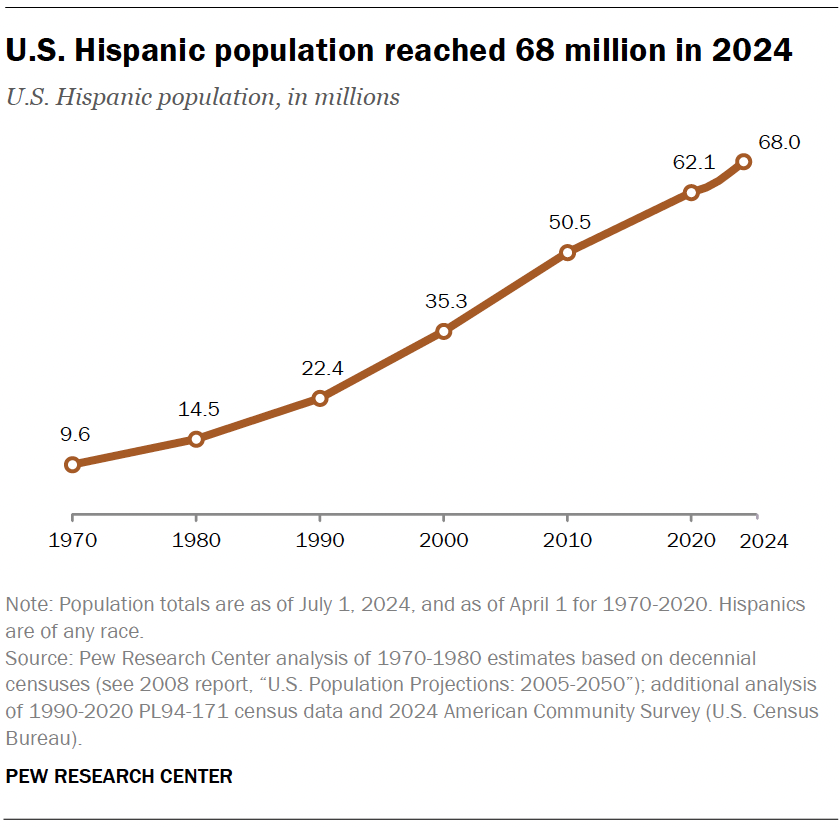

The fourth annual Global Financial Inclusion report highlights significant regional disparities and overall stagnation, underscoring the challenge in achieving SDG 10 (Reduced Inequalities).

- Top Performers: Asian economies, particularly Singapore (ranked first), Hong Kong, South Korea, and Thailand, demonstrate high levels of financial inclusion. China, Taiwan, and Vietnam show rapid improvement.

- Developed Economies: The United States and the United Kingdom rank seventh and tenth, respectively.

- Global Stagnation: The global average financial inclusion score remained static at 49.4 out of 100, largely attributed to a decline in employer support systems. This points to a need for stronger multi-stakeholder partnerships as envisioned in SDG 17 (Partnerships for the Goals).

Advancing the Sustainable Development Agenda Through Financial Education

Core Contributions to Specific SDGs

Investing in financial literacy is a direct investment in a sustainable future, with measurable impacts across multiple goals.

- SDG 4 (Quality Education): Foundational financial education for both youth and adults constitutes an essential life skill, promoting lifelong learning opportunities for all.

- SDG 8 (Decent Work and Economic Growth): By enabling smarter debt decisions and more productive investments, financial literacy fosters the economic stability and sustainable growth central to this goal.

- SDG 1 (No Poverty) & SDG 10 (Reduced Inequalities): Financial literacy empowers individuals to manage finances, avoid debt spirals, and build assets, providing a pathway out of poverty and reducing economic disparities.

Challenges and Policy Considerations

Limitations of Current Analysis

While the evidence is compelling, certain limitations must be considered when formulating policy. The methodologies for scoring financial literacy are not perfect, and establishing direct causation between literacy and economic outcomes remains complex. Furthermore, socioeconomic constraints can prevent individuals from acting on financial knowledge, highlighting that education must be paired with equitable access to financial services to effectively advance SDG 1 and SDG 10.

Conclusion: An Imperative for Global Action

Despite analytical challenges, the evidence strongly supports the conclusion that financial education is a crucial enabler of sustainable and inclusive economic development. To achieve the 2030 Agenda, a concerted effort under SDG 17 (Partnerships for the Goals) is required from governments, financial institutions, and employers to elevate financial literacy and inclusion globally.

Analysis of the Article in Relation to Sustainable Development Goals

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 4: Quality Education

The article’s central theme is financial literacy, which is a form of education. It emphasizes the importance of “foundational financial education” for both young people and adults to help them navigate complex financial landscapes, directly aligning with the goal of providing inclusive and equitable quality education and promoting lifelong learning opportunities for all.

-

SDG 8: Decent Work and Economic Growth

The article explicitly links financial literacy to macroeconomic outcomes. It cites a report suggesting that higher financial literacy levels can “boost GDP growth” through “smarter debt decisions and more productive investments.” This connection to economic productivity and growth is a core component of SDG 8.

-

SDG 1: No Poverty

By enabling individuals to make better financial decisions, financial literacy can prevent them from falling into an “unaffordable spiral of borrowing.” The article notes that improved financial understanding leads to lower loan defaults. This financial stability is a critical tool for poverty prevention and reduction, aligning with SDG 1’s aim to end poverty in all its forms.

-

SDG 10: Reduced Inequalities

The article discusses “financial inclusion” as a broader context for financial literacy. Financial inclusion aims to ensure everyone has access to financial services. The article also highlights a potential inequality by noting that “the less well off may not have a choice about borrowing less or investing more,” underscoring that improving financial literacy and inclusion can help empower vulnerable populations and reduce economic disparities.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

SDG 4: Quality Education

-

Target 4.4: By 2030, substantially increase the number of youth and adults who have relevant skills, including technical and vocational skills, for employment, decent jobs and entrepreneurship.

The article’s focus on financial literacy as a crucial skill for making wise borrowing, spending, and investment decisions directly supports this target. Financial literacy is a relevant skill for personal economic management and stability.

-

Target 4.6: By 2030, ensure that all youth and a substantial proportion of adults, both men and women, achieve literacy and numeracy.

Financial literacy is an advanced and practical application of numeracy. The article advocates for education on “interest, inflation and investment diversification,” which are core concepts of financial numeracy.

-

Target 4.4: By 2030, substantially increase the number of youth and adults who have relevant skills, including technical and vocational skills, for employment, decent jobs and entrepreneurship.

-

SDG 8: Decent Work and Economic Growth

-

Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading and innovation…

The article suggests that improved financial literacy leads to “smarter debt decisions and more productive investments,” which in turn “boost GDP growth.” This directly contributes to achieving higher levels of economic productivity.

-

Target 8.10: Strengthen the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services for all.

This target is the definition of financial inclusion, a key theme in the article. The text references the “Global Financial Inclusion report” and the goal of providing “government, financial sector and employer support for a country’s population,” which aligns with strengthening institutional capacity for financial access.

-

Target 8.2: Achieve higher levels of economic productivity through diversification, technological upgrading and innovation…

-

SDG 1: No Poverty

-

Target 1.4: By 2030, ensure that all men and women, in particular the poor and the vulnerable, have equal rights to economic resources, as well as access to… financial services…

The discussion on financial inclusion and “growing access to credit” directly relates to this target’s goal of ensuring access to financial services for all, especially the vulnerable who are more susceptible to unaffordable debt.

-

Target 1.4: By 2030, ensure that all men and women, in particular the poor and the vulnerable, have equal rights to economic resources, as well as access to… financial services…

-

SDG 10: Reduced Inequalities

-

Target 10.2: By 2030, empower and promote the social, economic and political inclusion of all…

The article’s focus on financial inclusion is a direct effort to promote economic inclusion. By improving financial literacy, especially among the “less well off,” it empowers individuals to participate more effectively in the economy, thereby reducing inequality.

-

Target 10.2: By 2030, empower and promote the social, economic and political inclusion of all…

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Financial Literacy Levels/Scores

The article explicitly mentions measuring financial literacy, stating, “each 1 percentage point improvement in financial literacy levels” and “a 10-point boost to financial literacy levels.” This score, often based on questions about interest, inflation, and diversification, serves as a direct indicator for SDG Target 4.4 (relevant skills) and 4.6 (numeracy).

-

Household Loan Default Rates

The article quantifies a direct link: a “2.78 point fall in household loan default rates” for every 1 percentage point improvement in financial literacy. This rate is a clear indicator of financial stability and responsible borrowing, relevant to measuring progress in poverty reduction (SDG 1) and sustainable economic practices (SDG 8).

-

Gross Domestic Product (GDP) Growth

The article suggests that a 10-point increase in financial literacy can lead to a “boost to GDP growth… of 0.3 percentage points.” GDP growth is a primary indicator for SDG Target 8.2 (economic productivity).

-

Financial Inclusion Score

The article refers to the “Global Financial Inclusion report,” which assigns countries a “financial inclusion score out of a potential 100.” This score is a direct indicator for measuring progress towards SDG Target 8.10 (access to financial services) and SDG Target 10.2 (economic inclusion).

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 4: Quality Education | 4.4: Increase the number of youth and adults who have relevant skills for employment and entrepreneurship.

4.6: Ensure all youth and a substantial proportion of adults achieve literacy and numeracy. |

Financial literacy levels/scores (e.g., a “10-point boost to financial literacy levels”). |

| SDG 8: Decent Work and Economic Growth | 8.2: Achieve higher levels of economic productivity.

8.10: Expand access to banking, insurance and financial services for all. |

GDP growth rate (e.g., “a potential boost to GDP growth… of 0.3 percentage points”).

Financial Inclusion Score (e.g., “global average was virtually unchanged at 49.4”). |

| SDG 1: No Poverty | 1.4: Ensure all men and women, particularly the poor and vulnerable, have access to financial services. | Household loan default rates (e.g., “a 2.78 point fall in household loan default rates”). |

| SDG 10: Reduced Inequalities | 10.2: Empower and promote the social and economic inclusion of all. | Financial Inclusion Score and rankings (e.g., “Singapore maintaining the top rank out of the 42 countries assessed”). |

Source: ft.com